|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Guyana

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

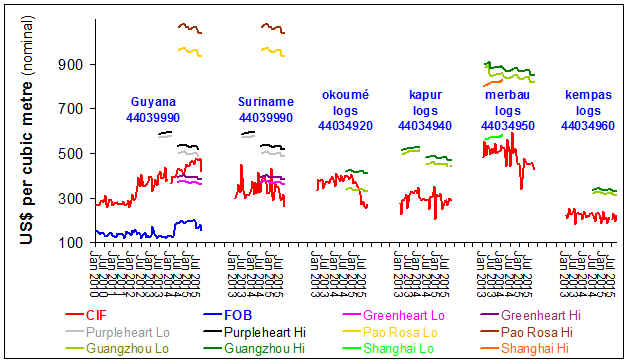

The only up-to-date statistics for production and trade for recent years which the Guyana Forestry Commission has made available to the public refer to exports of all forms of timber in aggregate. That one publication does so in units of export value (which provide little insight into the physical quantity exported), hampering assessment of potential transfer pricing fraud - which has for many years been a matter of concern for exports of logs to China and India. The following chart indicates that such fraud - whether privately condoned by officials or those in power - might be acute.

The chart above indicates that the mark up for insurance and freight charges for the supply of timber - other than logs destined for Asia (see chart below) which tend to be less costly to transport than sawnwood and plywood - to countries beyond the Caribbean is generally small relative to export value, including to New Zealand (implying that distance is a modest component of cost). As such, one might conclude that Guayana is loosing roughly US$ five million each year on its exports of logs to India and approximately three times that much on its exports of logs to China. It also suggests that - if the volumes declared were correct and if (during the period covered by the chart) the supply chains were from properly allocated, sustainably managed forest concessions and free of malpractice (concerning fees, taxes, corruption, etc) - Guyana could have charged almost double per cubic metre for logs exported to China and India, without making the trade unprofitable. Note that India has ceased being significant as a destination for Guyana's timber.

Guyana's exports of timber The chart above indicates that, for the last ten or so years, China has been the destination for a greater roundwood equivalent volume of timber than the rest of the world put together. Is China using that leverage to enhance forest and other governance or holding this back? Rong An, the enterprise which holds the largest area of forest concessions in Guyana, has applied to commence the logging of one of those concessions.[-] Given its history, it will be difficult for Rong An to demonstrate the expertise and willingness to sustainably manage that concession; both are presumably required if logging is to proceed. Mining interests support the application - because the logging roads which would be constructed will facilitate access, undermining any intent to manage the forest sustainably. Further, Rong An's sister company China Zhonghao has been barred from contracts funded by multi-lateral development banks on account of its fraudulent practices.[-] China Zhonghao's unusual achievements in Guyana have also led to allegations of malpractice.[-] [-] With such a background, and China's (June 2020) law prohibiting illegal timber,[-] [-] it would be inconsistent for China to continue to import wood from Rong An. Elections during 2020 have returned to power the party which - given public disgust for its corruption - lost the previous election. That 2015-2020 governmentplanned to restructure the Guyana Forestry Commission ("GFC"), citing the inability of the GFC to pay its bills.[-] That inability implies that the GFC was not charging or collecting sufficient from those to whom it has allocated logging concessions and from those who export logs to China and India. The GFC's then Commissioner retired in 2020.[-][-] The report of an independent audit into the GFC, initiated in 2019[-]. A series of Forest Monitoring audits have been completed. The findings of the most recent were not only complimentary but accepted the GFC's view that allegations of corruption were baseless.[-] Transparency, the cornerstone of good governance, continues to be lacking in relation to Guyana's exports of timber - most notably of logs (given concern about under-invoicing and other fraud relating to exports). As the following chart suggests, the export of logs (implicitly inconsistent with government policy) is much less remunerative for Guyana (and correspondingly more profitable for exporters) than the export of sawnwood.

"Value added" by transformation of logs in Guyana prior to

export A preference not to publish meaningful reports on the market context of the VPA between the EU and Guyana presumably gives the government of Guyana the impression that the EU is not interested in these plans or governance in the forestry sector - other than in relation to the tiny volumes of wood (all destined to the EU) which are within the scope of the VPA. A very large area of forest land (about 0.8 million hectares) formerly logged by Barama (which, for understandable reasons including legal compliance, has quit) is being reallocated as SFEPs (exploratory concessions) to two enterprises.[-] [-] Neither has proven expertise in sustainable tropical forest management (or its planning). One (Chinese), having alienated people locally[-], holds a similar concession which has been illegally extended. That Chinese group has no prior experience of sustainably managing tropical forest. A boat of which it is the registered owner has been seized in St Lucia for drug and weapon smuggling[-]. Due diligence and performance bonds would presumably be required prior to the allocation of the two concessions, but evidence of each is lacking. If the process of allocation has not been legally compliant, then this would imply that (i) the sort of practices which enabled Barama and Bai Shan Lin to flourish persist within Guyana's public sector, and (ii) the entrerpeises would hve no legal recourse on prermature termination of their concessions are withdrawn. Media reports[-] suggest that, if those SFEPs subsequently become long-term concessions, annual export revenue would increase by US$ seven million if the combined Sustainable Annual Allowable Harvest (or more than 180,000 cubic metres) were extracted. Given that end-use in Guyana is unlikely to greatly increase from its current level, the great majorty of that additional volume will presumaby be exported. However, this would imply a unit export vaue of US$35 per cubic metre - an order of magnitude less that the paltry amount which Guayana currently achieves from the export of logs. Although the government suggests that these concessions will promote the explotiation of "Lesser Used Species", the concessions are known to be particularly rich in species having high commercial value, implying that referring to them as "Over Used Species" would be more appropriate!. Under flawed regulations concerning the proportion of the SAAH which can be extracted during the term of an SFEP, the two enterprises might strip all that timber, substantially reducing the remaining value of the forest. What used to be one of the largest logging groups in Guyana markets timber from Guyana in the USA.[-] This does not automatically imply that the authorities in the USA consider that those products would be deemed legal in the USA - under the USA's amended Lacey Act. The Guyana Forestry Commission has suspended two forest concessions acquired by a Chinese group (now known as China Resouces and Transportation Group) - those of Jaling and Garner.[-] This follows an announcement that the GFC is to not only reposess a number of concessions linked to another Chinese group - Bai Shan Lin - but also "accelerate" efforts to reclaim debts owed by that group.[-] According to a recent media article [-] (the head of what is the largest logging enterprise in Guyana claims that) thousands of "indigenous citizens" employed in order to supply greenheart logs are in jeopardy due to the UK's public producement policy. Very small volumes of sawn greenheart are supplied to the UK - and it seems unlikely that more than about 200 people would be directly involved in felling the trees from which those exports derive (a rare surge during November 2014 explains the apparent decline between 2014 and 2015 referred to in that article). Guyana should carefully check that the benefits which that large enterprise claims to bring Guyana (especially in export taxes, particularly for purpleheart) reflect reality. The peoples of Guyana would expect no less when the party in power considers whether to renew the anachronistic inward investment support which previous governments have repeatedly renewed despite that enterprise being unable or unwilling to both transform logs in Guyana and successfully market the output (- as the fourth chart below indicates, the enterprise's production of plywood has, since about 2011, been much less than previously). Recent media articles also imply that it is no longer feasible for companies (in the UK) to procure sawn greenheart from sources in Guyana that are demonstrably sustainable - even in tiny quantities - as (very reasonably) required under the UK's Public Procurement Policy.[-] (A different policy instrument, the EUTR, requires due diligence concerning legality.) That inability partly reflects the progress which the FLEGT Action Plan has been able to make (despite the proposed VPA currently being confined to exports to the EU, much of which comprises sawn greenheart destined for the UK). Judging by extensive media coverage, it may also partly reflect a decline in performance of the Guyana Forestry Commission during the last decade or more, which in turn would seem consistent with allegations of complicity by senior officials in degrading Guayana's forest heritage (particularly in cahoots with Chinese, Indian and Malaysian enterprises).[-][-] Guyana has been aware of concerns about the sustainabiity of logging greenheart for many years. During 2007, the Guyana Forestry Commission petitioned the IUCN against listing greenheart's status as vulnerable. Significantly however, the GFC chose not to provide evidence justifyng its petition.[Section 3.1] The apparent preference of the GFC (or those with greatest power within it) to not address those concerns has resulted in widespread acceptance that the logging of greenheart in Guyana is generally unsustainable[-]. The GFC's performance with respect to greenheart - a flagship species for Guyana - has implications for other species (and the future of Guyana;s forest ecosystems (- notwithstanding rewards from Norway for performance in the context of deforestation rather than forest degradation). Although the volume of sawn timber which the UK imports from Guyana is not negligble and more than the rest of the EU combined, it is nevertheless generally very small (typically about 200 cubic metres per month - but, depending on the species, even this might be excessive relative to the volume which could be exploited sustainably).[-] However, that volume is small relative to the total which is either imported by countries in the Caribbean or used in Guyana. As the lowermost two of the three charts immeditely below illustrate, the EU imports imports an even smaller volume of logs from Guyana (and the UK none). In comparison, Guyana exports much greater volumes of logs to China and India - despite the export of logs being contrary to government policy (and all too often being associated with unsustainability and illegality).

EU member states' imports of sawn wood from Guyana

It would be be remarkable if Guyana were to extend

any investment incentives - or logging licences - to what seems to

be one of the most controversial yet favoured foreign companies in

Guyana (Barama). The decline in its production of plywood is

presumably attributable to its own performance, the exhaustion of

suitable trees (FSC-certification was withrawn from its logging

concession some year ago) and more lucrative opportunities for

exports of logs. It is unclear why,

according to media reports, the government is minded to renew

agreeements it made with that company including some made almost 25

years ago (- rather than seeking to recover any misappropriated

investment incentives). The European Commission seeks to negotiate a

Voluntary Partnership Agreement ("VPA") with Guyana (as a component of

the its FLEGT Action Plan. The UK is leading those negotiations on behalf of the EU,

in addition to working with Guyana as part of its Forests Governance

Markets and Climate programme[-]. One might imagine that the

earliest joint initiatives under the VPA would be to ascertain

what steps are needed to sufficiently reform forest management and

related practice concerning state revenue to make the VPA

worthwhile, rather than a political charade. The context is

clear - the EC / UK can not reasonably claim naïvety concerning

widespread allegations (supported by strong evidence) concerning

malpractice at senior levels within the government of Guyana -

including the Guyana Forestry Commission. Indeed, those

allegations may seem more than sufficient to have provided a basis

for immediate action, if both parties to the VPA were sufficiently

committed. A first demonstration of

commitment by the EC / UK would presumably be to offer technical

assistance to support robust legal defence against claims by

foreign enterprises having interests in logging and timber exports

(for example Bai Shan Lin, partly owned by the governent of China[-]).

Depending on the extent to which key

people in it are already compromised, one might expect that the

government of Guyana would welcome that support, especially in so

far as its electoral victory in 2015 was attributable to a

manifesto commitment [p7]

to root out relevant malpractice. Understandably, the EC /

UK might be unable to provide such support unless the government

of Guyana requests this. The government of China would presumably

welcome such support; failing to do so would tend to imply

complicity in the alleged malpractices and that, if its

regulations concerning the overseas operations of Chinese

enterprises can be disregaded by to state-owned enterprises, then

they can be disregarded by all others. Subsequent to an export ban being imposed on a

state-owned Chinese logging group, the volume of logs exported to

China has declined - having surged during 2013 and 2014. The

volume of logs exported to India is increasing. The volume of

plywood being exported has declined to almost negligible level,

despite plywood being a primary reason why very generous inward

invetment privileges were extended decades ago to the country's only

plywood manufacturer and which allegedly persist. It is likely that one of China's largest

state-owned forestry enterprises, Longjiang Forest Industry[-],

will acquire the most controversial (Chinese) logging group in

Guyana.[-]

It is presumably coincidence that a director of that group[-]

has a the same family name as a senior Chinese diplomat in Guyana.

Longjiang Forest Industry has no experience of managing tropical

forest and, judging by a recent logging ban[-][-],

has a track record of logging unsustainably in China. Guyana's

Minister of State appears to have been the guest[-] of the two groups

during a recent visit China, which took place soon after he had halted

efforts to impound some of that group's vehicles pending payment of

substantial tax arrears.[-][-]

It is unclear whether the group has subsequently complied in full with

its tax obligations. Longjiang Forest Industry's acquisition of Bai

Shan Lin is unlikely to comply with the government of China's

guidelines concerning overseas forestry - because the latter's

forest-related operations appear illegal, according to media

commentary and a recent forensic audit.[-][Section

5.5]

Under the EU's FLEGT Action Plan, a Bilateral

Co-ordination Mechanism between China and the EU has been

established. Those who fund the Voluntary Partnership Agreement

which Guyana is negotiating with the EU have a duty to advise China of

this situation and could do so through that Bilateral Co-ordination

Mechanism. However, there is a lack of evidence the EU has

sought to do so. This reflects norms which have evolved under

the FLEGT Action Plan, in relation to countries negotiating or

implementing Voluntary Partnership Agreements with the EU and

elsewhere (not only in the countries from which China imports

"rosewood"[-]).

China imports most of the tropical timber (especially logs) which are

exported from those countries.[-]

Exports of logs from, and transformation of logs in, Guyana This chart indicates that certain species

(particularly Purpleheart and Wamara) are being over-exploitated

and under-taxed. Their chains of supply tend to be dominated

by a small number of foreign companies who enjoy the - implicitly

counterproductive - inward investment incentives which those with

power in Guyana so generously give on behalf of the peoples of

Guyana. This points to negligence or worse by those in power. A

recent forensic audit of the sector did not assess whether those

incentives were a net benefit to Guyana - either financially or,

given persistent allegations of illegality and unsustainability, in

terms of governance.

China's imports of logs from Guyana - by "customs district" China's interest in the sort of logs which it has imported from

Guyana (and several other countries) has declined steeply during

recent months, due particularly to the adjustments (away from

conspicuous consumption towards social and environmental

sustainability) which are being made to China's economy (and which

are also needed in India). This change in economic paradigm

makes it more prudent for Guyana to manage its peoples' forests

sustainably than for log exports, which would in turn tend to justify further

REDD+ related funding from Norway.

China's imports of logs from Guyana - by "location of

importer" For statistics

of India's and China's monthly imports of logs from Guyana, please

see

tables at the end of this webpage.

FOB, CIF and ITTO wholesale prices

- logs from Guyana, Suriname and selected species |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Guyana The following provides a summary concerning some of Bai Shan Lin's apparent holdings of forest in Guyana. Through joint ventures or takeovers, the group appears to control a number of Timber Sales Agreements (logging concessions). The group's apparent joint ventures concerning a number of other forest concessions are allegedly being contested in Guyana's civil courts. The Guyana Forestry Commission has rejected or does not acknowledge the group's interest in some further concessions. Of the State Forest Exploratory Permits held by the group, one has expired but is still being logged, one will soon expire but without completion of its requirements, and one has been converted to a Timber Sales Agreement (but this would presumably have required prior Presidential permission, which is unlikely given that the requirements for conversion were not completed). Joint ventures or takeovers of Timber Sales Agreements is illegal unless Presidential permission has been previously granted.A forensic audit[Section 5.5] of the Guyana Forestry Commission has recently concluded that a (controversial [see below) logging group is in breach of various regulations and that - amongst other things - a number of the logging concessions which, in effect, that group controls should be cancelled.[-] Significantly, the audit report questions why the GFC at least tacitly supported the group. The auditor does not seem to have investigated whether the group has pledged any of its assets to lenders, notably the China Development Bank, in return for loans. The value of any collateral linked to assets (including through shareholdings) which the group is obliged to return to the state would be zero. This, and non-compliance with guidelines set by the government of China concerning forest-related investment, will presumably increase the difficulty that the group will secure further loans. The group's interests in Guyana's mining (and other sectors[-]) are also highly controversial, particularly the speed at which it obtained licenses.[p3][-] If the government of Guyana considers that the risk that the group will "walk away" is non-negligible, then it would presumably be taking steps to ensure that vehicles and equipment which have been brought into Guyana by or on behalf of that group (particularly under FDI arrangements) can not be repatriated until the group has fully paid any penalties which are now or subsequently become due. If it is found that the group has been under-invoicing its exports then the government of Guyana might demand retrospective payments in addition to penalties. According to the auditor's report, the export value of the logs which that group has exported over several years from Guyana is approximately US$ eight million. However, that amount is much less than that implied by the group's chairman - who states that the group exports US$400,000 of logs per month.[p3] This tends to support allegations that the group procures logs from small scale producers and others (particularly from the hinterland) before exporting those logs itself, which would probably be in breach of the Customs Act - such producers would otherwise appear on customs documents to be exporting direct to customers in China (which is rather unlikely). The failure of the Guyana Forestry Commission, the Customs Service and the auditor to consider and act on such allegations raises fundamental questions. Procuring from small scale procurers or informally, although likely to be illegal, is not uncommon for Chinese traders in other countries (notably DR Congo and perhaps also in Peru) and tends to support the view that such trade tends to embed corruption. The under-invoicing of exports is another matter which the auditor does not seem to have investigated. Instead, the auditor seems to have accepted at face value information from the Guyana Forestry Commission which, judging by media articles, has been remarkably supportive of the group. That said, the Board of Directors of the Guyana Forestry Commission has recently been replaced.[-] The auditor's report also includes an assessment of a controversial foreign-owned logging to coffee bar group. However it does not refer to another (Chinese) group which media reports allege has gained logging (and mining) rights under questionable circumstances and without the consent or knowledge of the region's Amerindian people[-][-] and without experience as a logging company.[pp32-33] The recent downwards trend in China's economy (and stock market valuations) probably better explain the downwards trend in Guyana's exports of logs to China than any greater compliance with the law and government policy in Guyana. China's imports of tropical logs, particularly those of high unit value such as wamara (preferred by at least one controversial enterprise in Guyana[-]) have declined steeply[-]. Such species are now much less fashionable amongst speculators and the wealthy in China. Given that such enterprises' markets are in decline, their interest in Guyana is unlikely to be long-term. Consequently, it would probably be inappropriate to extend or grant them long-term tax or other exemptions. The declining market should be taken into account also by those who are considering whether to lend to the controversial group described above. The Voluntary Partnership Agreement currently proposed between the EU and Guyana is unique within the EU FLEGT Action Plan in being confined to the supply of timber from Guyana to the EU. This will enable Guyana to do the minimum needed to comply with the terms of its "REDD-related" payments from Norway, rather than improve governance of its forest sector (which would require the scope of the VPA to include exports of logs, and exports to China and India) - undermining the aims of the FLEGT Action Plan. The EU accounts for an almost negligible share of Guyana's timber exports. The cost of negotiating and implementing the VPA prior to FLEGT-licensing would be large relative to the revenue which Guyana would derive from the small volumes of timber which Guyana exports - if the VPA is confined to exports to the EU. The impact of the EC's Regulation 995/2010 (the "EUTR", which requires "Operators" too ensure the products they place on the EU market have a negligible risk of being illegal) appears to have had a significant impact on those exports - the volume having declined prior to March 2013 (when that regulation came into force) and has subsequently increased (presumably because importers are now confident in the legality of their sources of supply). The great majority is imported into the UK (about 200m3 of sawn wood per month). The uppermost chart above indicates that declared FOB prices for Guyana's exports of logs to China tended to remain constant between January 2010 and April 2014 before rising 50% during the following month to a new plateau. In contrast, the corresponding CIF prices declared in China have risen strongly since the end of 2011. The difference in trend is consistent with increasing freight costs and with allegations of customs fraud in Guyana[-][-][-], but might have other explanations. Wholesale prices in Guangzhou quoted by the ITTO for Greenheart and Purpleheart during 2015 do not correlate closely with those CIF prices. However, they imply that the mix of species being imported into China from Guyana is increasingly of species having greater wholesale price than either of those two species. (The opposite trend is indicated for logs from neighbouring Suriname.) The difference between CIF and wholesale prices for logs of specific tropical species imported by China other than from Guyana (and for Purpleheart during the second half of 2013) appears to have been in the range US$100-200 per cubic metre. There is significant concern (including in China) about the activities in Guyana of a Chinese company and inaction by the current (and previous) government of Guyana to properly address the implicit malpractice which allegedly characterises those activities - and damages China's international stature. The China Development Bank, which is funding a controversial major expansion in pulp production in South Sumatra (Indonesia)[-][-], is understandably reluctant to support the company (not least because, as a flagship for Chinese international investment, it is subject to (albeit voluntary) guidelines concerning the forest sector. The company appears to control logging in a large percentage of Guyana's forest land, and has diversified into mining, haulage, construction and property development (substantially reducing the size of the market for Guyanese enterprises, and tending to use Chinese personnel). However, the subsidies which that company received from the previous government were intended to help the company establish itself in Guyana particularly in order to add value to Guyana's timber industry by transforming logs prior to export. Despite that diversification, the subsidies (which, like those of a sino-malaysian multinational logging group, presumably remain current despite many years elapsing since the company became established), the failure to establish a mill (presumably in breach of its FDI agreement), the area of forest it controls, and - importantly - a booming market in China, the company claims to be in financial difficulty. The company has requested that the government of Guyana allows it two further years in which to establish suitable mills. There are no reports that it has offered credible guarantees to do so or to pay any penalty if it does not. Its annual accounts are not available to the public, but have presumably been audited by reputable accountants. Title to at least one of the concessions over which the company appears to have operational control is held by an enterprise which is in a precarious financial position and listed on the Hong Kong stock exchange. That enterprise has title to two concessions (Garner and Jaling) and diversified into forestry through those concessions (albeit for reasons which seem unclear, speculation aside). Its business in Guyana has not declared any taxable profits and the total of the "impairment costs" which it reported concerning the net value of its concessions during FY2013, FY2014 and FY2015 is equal to half the declared cost of those concessions - implying substantial overestimates and/or forest exhaustion. The government of Guyana appears to have responded vindictively to the exposure of its generosity in providing duty free exemptions to one of the largest and most controversial foreign logging groups operating in Guyana - one which, being linked to a state-owned enterprise of one of the wealthiest countries in the world (China), might not need those exemptions and (in so far as its parent group pays taxes in China) would transfer to the government of China at least some of any declared profit accruing from those exemptions. That company is alleged to use various ruses to renege on its offers to pay Guyanese workers. There has been much well informed criticism of the government of Guyana's relationship with that company (and others), including in public hearings[-]. The company is understood to have recently constructed roads to gain access to logging and mining concessions - without having (let alone implementing) approved environmental and social impact assessments - and to have carried out unauthorised logging operations which have been endorsed by the Guyana Forestry Commission.[-] The company has generated considerable opposition from Amerindian communities whose land appears to have been acquired by the company for logging, The government of Guyana's embarrassed response to the large apparent expansion in that group's extractive, exploitative "investments" revealed in Guyana's understandably polarised media tends to confirm the criticisms of that group and the government's relationship with it[-]. The data tables which that response presents, in so far as they exclude the logging concessions directly allocated to the group[slide 6], are not comprehensive (and present production statistics for only part of the year 2014 as if they were for the complete year). However they clearly demonstrate the group's (implicitly illegal) unsustainable forest management strategy of abandoning concessions having stripped them of timber of the quality sought be its markets.[-][-] This directly contradicts the government's embarrassed response [This means that there is no overharvesting by Bai Shan Lin] and which is either naïf or disingenuous in ignoring that the sustainable yield is theoretical and assumes that a broader mix of species is being extracted than that which the group exploits. Remarkably however, the Guyana Forestry Commission is understood to have changed its Code of Practice (so that it waives the requirement for sustainability, something which is presumably contrary to its remit and/or Guyana's constitution). In addition, that apparent expansion (and the hype - in China - surrounding it)[-] would be consistent with the success of the group's efforts to borrow - presumably in return for logs of the species which, as the government's embarrassed response tends to confirm, Wamara. Although wamara (Swartzia spp.) is not currently classified as "hong mu" - which has special status in China - the (often speculative) expansion of markets for "hong mu" has been so rapid and large that it is inconceivable that "look alike" species such as wamara are not also subject to such "demand". The difficulty of securing sufficient wamara (and presumably pressure to repay its creditors) might explain the group's interest in ad hoc purchases and its landlording of logging concessions. The announcement [-] [final ¶s p10] that wood from a tree plantation (yet to be established) will be transformed into pellets in Guyana for shipment to Europe where it will be burned is inconsistent with the reality of the woody biomass market in Europe. The supply of pellets from Liberia and South Africa to the EU has now ceased. At least one major low cost producer in Brazil no longer plans to supply pellets to Europe.[-] Ghana will probably cease exporting pellets once its cheap source of supply - old rubber trees[-] - is exhausted. It is now recognised that although wood is renewable, burning it (instead of fossil fuel) to generate heat and power tends to increase greenhouse gas emissions.[-] Also, the co-firing of pellets with coal tends to be heavily subsidised,[-] including indirectly by failing to tax or otherwise account for the greenhouse gas emissions of bunker fuel[-] (for ships). It is most unlikely that pellets from Guyana could compete against supplies from south eastern USA (which are fifty times greater in scale - 3.5 million tonnes during the year to 30 06 2014 - and which tend to use specially designed transportation systems) in the two largest segments of the EU market for woody biomass - power stations and residential or municipal users (- much of the latter being supplied from local woodland). As in a number of other countries (notably Mozambique) China's impact on Guyana's logging and timber processing industries is transforming local markets. The latter industry is being undermined by imports from China of cheap furniture having a probable life much shorter than that of furniture made in Guyana which it is displacing. The apparent market within Guyana for logs of the species previously used in making such furniture is contracting to the point at which exports (typically to China) are almost the only option available to logging companies (other than letting the trees live). The government of Guyana could deploy a range of fiscal and policy measures to sustain its timber processing industry [5 p18] and thus avoid the social and economic cost of loosing this. However, it appears that the government has chosen to apply such measures in ways which suit certain vested interests, both local and foreign. This has come to a head in recent, sustained discussion in the media, which includes detailed allegations and apparently misleading responses from government. In addition to that discussion, one might wonder why the (audited) annual accounts of an "investor" (registered on the Hong Kong Stock Exchange) - whose logging interests in Guyana might be linked to the largest Chinese group operating in Guyana's timber sector - show persistent large losses, both in relation to sales revenue and asset value. Those losses seem inconsistent with the rapid expansion of that Chinese group in Guyana. However, such losses in revenue and/or asset value seem common to companies which have or until recently had logging or "forest development" interests in China and/or overseas and which are or until recently were listed on the Hong Kong or Toronto stock exchanges.[-][-][-][-][-][-][-] One of the two largest logging groups operating in Guyana (both are foreign) has plans to log a very a large proportion of Guyana's forest area and to mine gold. Such operations are likely to conflict with Guyana's Low Carbon Development Strategy and REDD+ initiatives supported by Norway. The company describes as "investment" the cost of constructing the infrastructure which will enable this asset stripping. However, it appears that that same company is exporting volumes of logs well in excess of that which is expected from State Forest Exploratory Permits[-][-] - and therefore without proper authorisation, and doing so both directly (from Kwakwani) and after transportation to Georgetown in containers on lorries driven not by Guyanese but by east Asians. The "spiralling demand" for tropical logs in China[3.2.3] (and to a very much lesser extent India) is attributable largely to the continued willingness of both China and other countries (including those which prohibit illegal wood-based products, such as the USA and the 28 EU member states) to turn a blind eye to the legality and sustainability of those logs' provenance. The legality of concession allocation, subcontracting of logging or logging by front companies, the export of species in volumes exceeding quota, the independent inspection of consignments prior to export and the rights of forest peoples should be cornerstones of the VPA which Guyana is negotiating with the EU - unless both intend the VPA to be window dressing. If, as is likely, the government does not have records of the projected and actual fiscal balance between the benefits and cost (to Guyana's treasury) of special tax incentives and the like in relation to particular logging groups, then this might simply reflect weak government capacity. However, it might imply corruption. The likelihood of the latter would presumably need to be assessed by those carrying out due diligence under EC Regulation 995/2010 and the Lacey Act given their obligation to minimise the risk that products they place on the markets of the EU and USA respectively are illegal. The Guyana Forestry Commission has not published sufficient recent forest inventory, roundwood production and export data to judge whether, as seems likely, the rate at which a number of tree species are being exploited is leading to their exhaustion - particularly those in which there is substantial interest from China (notably wamara and other Swartzia spp.). Relations between the Chinese group which controls most of Guyana's industrial-scale logging concessions and the government of Guyana appear close - that group is also providing basic construction services, thereby denying Guyanese contractors and their workforce those business opportunities. That group's control over relevant policy-making in Guyana appears to have become so extensive as to warrant remark in Guyana's media. Recent reports referring to Guyana's timber industry and its exports (including one concerning its competitiveness as a cluster - funded by the UK, Canada and the Inter-American Development Bank) seem to ignore or downplay the dominance of the industry by foreign interests, particularly those from China, and to focus on sawn wood rather than logs - despite the latter being much more controversial than the other timber products which Guyana exports. This contrasts with other reports of dubious ventures in Guyana for which China provided or has offered to provide debt. Indeed there appears to be increasing concern about the level not only of Guyana's debt to China but also of China's concommitant control over Guyana's economy. Analysis of the financial accounts of the Guyana Forestry Commission suggests the prevalence of large scale impropriety. This analysis makes the timing of a substantial grant from the Inter-American Development Bank ostensibly to support REDD+ in Guyana all the more remarkable. Due diligence would presumably require the Technical Co-operation consultancy proposed under that grant to report whether malpractice by the authorities is - as in a number of other countries - in effect the greatest threat to Guyana's forest. The Forestry Sector Information Reviews for the last three years indicate that log production during the month of December tends to be between two and five times as great as during other months of the year. Temporary surges at year end - when Guyana Forestry Commission ("GFC") inspectors are likely to be on holiday - do not seem to have taken place during previous years. The most high profile changes in the industry during the least few years has been increased interest by "Asian" enterprises. Inevitably perhaps, this makes it seem not only that those enterprises are cynically exploiting the established routine of the GFC but that they lack commitment to Guyana and its peoples' forest. Given that export volumes do not exhibit such a spike, it may be that the logs produced at year end are stockpiled for export or transformation later in the year. Such stockpiles if not clandestine, would presumably be easy to find. If the declared FOB price at which logs of certain species are exported were much less than the price at which those species were advertised in relevant newspapers for sale to the market in Guyana, then this might indicate that those who seek to export logs are exploiting loopholes in Guyana's policy concerning the export of logs. The lower chart above illustrates the extent to which that policy (which seeks to promote the export of processed timber, not logs) is being flouted. (If the price advertised to the local market were exorbitant, there would appear to be no local interest, thereby making it easier to argue that the logs should be exported.) Assuming that there is no collusion, it would presumably be in the GFC's interest if such as an assessment were carried out. Presumably, the Voluntary Partnership Agreement which Guyana is starting to negotiate with the EU will resolve whether the EU is to regard as legal the illegalities with which a number of foreign logging groups in Guyana are allegedly associated. Guyana's motivation in seeking that VPA might change once funds which are being withheld under an agreement between Norway and Guyana are released. During 2012, a roundwood equivalent volume of approximately 120,000 cubic metres of timber was exported from Guyana. China and India each account for about one quarter of the total, almost entirely as logs. A further 3% was destined for the EU, predominantly as "undressed" sawn wood having an export value of little more than US$ two million. This accounts for a large majority of the roundwood equivalent volume which is exported from Guyana. Nevertheless, a Chinese enterprise seems to have negotiated rights to log 300,000 cubic metres - twice as much as this - in order to supply a proposed saw mill, consequently casting doubt about sincerity of Guyana's Low Carbon Development Strategy.[-] Further, there is unlikely to be a market for the output of that mill (or the logs from a number of the concessions which Bai Shan Lin appears to have taken over), This is because there is non-negligible risk that taking over those concessions is contrary to Guyanese law, which would presumably be unacceptable under the VPA and which is unacceptable under the USA's Lacey Act and the EC's Regulation 995/2010 (which prohibit the placement, on the USA or EU market respectively) of wood-based products which have a non-negligible risk of being illegal, whether supplied directly or indirectly, e.g. via India or China). The Guyana Forestry Commission is reported to be keen to support those who exploit forest through Community Forestry Organisations in increasing the supply of timber for export.[p12] This might reflect exhaustion of commercially attractive species in industrial-scale concessions ("Timber Sales Agreements"). Prior to allowing such exploitation, communities should reflect on the profit which those further down the supply chain are likely to make at their expense. Formal consultancy reports are said to identify not only numerous defects in the Legality Assurance System which the Guyana Forestry Commission "GFC" proposes (and in how the GFC interprets the law) but also weaknesses in forest management practice in Guyana. Recent media articles indicate that Guyana's informal trade in timber (by the ethnic Chinese diaspora, some of who's residency status is likely to be questionable, as in Suriname) is increasingly manifest and has become an integral component in the export of Guyanese timber. This is contrary to the policy of the GFC - and probably illegal. This and other probable illegalities concerning Guyana's timber exports seem to be condoned by the authorities - and to contradict GFC rhetoric. This does not necessarily reflect Guyana's reputation for corruption (score 2.5 on TI's most recent CPI). Although the volume of plywood which is exported from Guyana (roughly 400m3 monthly) is currently a small fraction of what it used to be, there has been no change in the fiscal concessions which have for a number of decades been granted to one of the largest logging groups operating in Guyana - this apparent generosity by those at the highest levels of government (supposedly on behalf of the peoples of Guyana towards that logging group might reflect powerful vested interests. Neither GFC reports nor the media appear to mention how and to whom the c.700,000ha increase in Timber Sales Agreements was assigned during the second half of 2010 (presumably from previously Unallocated Forest).[Table 2 and Table 2] This and the other apparently unexplained changes in forest allocations might reflect manipulation by those in authority, and as such might compromise the monitoring of relevant supply chains and assessing their legality. That the Minster for Forestry is the current President begs interesting questions in this respect. Guyana is negotiating a Voluntary Partnership Agreement with the European Union "VPA", one component of which would require implementation of a Timber Legality Assurance Scheme "TLAS". Remarkably, assessment of such processes (fundamental to governance) as those by which (a) forest has been designated for logging or conversion, (b) concessions have been allocated, and (c) the logging entity authorised, do not seem to be required in the TLASs which the EU is negotiating elsewhere.[Cameroon Congo Ghana] Documents rubber-stamped by relevant officials are deemed sufficient. If such rubber-stamped documentation is deemed insufficient evidence of legality under the EU's Regulation 995/2010 (which requires due diligence to exclude Illegal Timber from the EU market) it would seem to be in Guyana's interest to establish a VPA - from the 3rd of March 2013, that regulation will make it illegal to place Illegal Timber on the EU market, unless consignments (or illegal components thereof) derive from countries which are implementing a VPA. As the upper chart above shows, the quantity of timber being exported from Guyana has risen strongly since the signing of the MoU between Guyana and Norway (November 2009), particularly as logs whose export is officially discouraged. Under that MoU, penalties will be triggered if timber production annually exceeds the average for 2003-2008[p20] and if the percentage of timber production which is illegal exceeds 15%[p22] (the Illegal Timber content of Guyana's timber exports to India and China is likely greatly to exceed 15%). Further evidence that Guyana is not serious about reducing deforestation or forest degradation derives both from the number of logging concessions being granted - which has increased - and the nature of the enterprises which have been allocated the new concessions (- see below). In addition, it appears that cocaine is being smuggled out of Guyana in containers with timber illegally [Aroraima 180m3] supplied by Chinese nationals (linked to well-known restaurant). Disputes about where the different authorities' jurisdictions start or end, and a previous order to reduce surveillance, would be consistent with high level interest. Failure to notice the fraud (illegal timber) tends to indicate that routine monitoring systems being used by the Guyana Forestry Commission are not fit for purpose, and this begs questions about claims submitted by the GFC under the MoU. Remarkably, the MoU requires that measurement of forest degradation ignores one of the most fundamental characteristics of forest vitality - their mix of species (both of trees and their mode of reproduction, including the recycling of their nutrients).[p19-22] Since late 2009, the only destinations willing to accept Guyana's plywood exports have been local - the former primary markets of the USA or the EU now have or will soon have legislation which in effect prohibits the import of Illegal Timber. The benefits which Guyana has secured from its tax concessions to foreign enterprises in the timber industry seem negligible - though their cost is substantial. The government of Guyana, a country which is both one of the most corrupt in South America and noted for links to the illegal drug trade, is to receive a grant of US$30 million from the government of Norway. The grant is an initial instalment of a much larger payment which is supposed to reward the people of Guyana particularly for the retention of their forests' eco-system so that other countries can continue causing climate change through their consumption of carbon. The much larger payment would be made even if deforestation increases - as is likely given plans to construct a controversial hydro-electric project. Norway will reward Guyana for increasing deforestation by between 50% and 400%.[p15] The Amaila Falls project is to be funded partly by the China Development Bank[-], and likely to use imported Chinese labour rather than Guyanese[-]. Although the ostensible purpose of this project is to substitute for electricity generated by current fossil-fuel power stations, the project might instead supply export-oriented refineries which have yet to be built.[-] The route chosen for a new road to the project site conveniently passes through a mature forest ecosystem. The likely sub-contractor for the road is one of the three foreign logging groups which supply the great majority of the timber which is exported from Guyana to China and India. The government refuses to publish the mandatory environmental impact assessment of the project and this access road.[-] Norway's initial payments will presumably help commit Guyana to implementing this costly hydro-electric project prior to general elections in 2011...[-] The Norway-Guyana agreement does not seem to require Guyana to address the primary drivers of forest degradation in Guyana - mining (particularly of gold) and, less lucrative, logging, both of which tend to be not only illegal and unsustainable but also associated with poor governance. In so doing, Norwegian taxpayers snub their counterparts in the UK who, particularly during the 1990s, provided extensive funding and technical assistance to the Guyana Forestry Commission in order to help ensure sound management of Guyana's forest and timber trade. Opportunities to take advantage of poor governance under REDD have already attracted criminal interests.[Interpol] Under REDD, forests are being treated as if they were merely agents for the sequestration of carbon (rather than for their social and environmental services locally and globally) and, as such, tradable by those who wish to continue to supplement the already dangerously high levels of greenhouse gases in the atmosphere. The Auditor General of Guyana has commented on financial chicanery by the office of the President of Guyana.[-] Instances of a similar character relating to funds disbursed under the MoU between Norway and Guyana are apparent.[-] Despite major flaws, the government's Low Carbon Development Strategy has some encouraging points.[-] However, a McKinsey report[-] concerning incentives to avoid deforestation in Guyana appears to be based on a flawed appreciation of the potential of Guyana's forest land and the reality of Guyana's forestry sector.[-] The unit prices cited in the ITTO's fortnightly "Tropical Timber Market Report" indicate that the difference between the unit prices for Guyana's log exports are remarkably small relative to unit prices for equivalent products exported from other producer countries. The difference might well be attributable to transfer pricing fraud. Given that, during 2005, logs account for almost all India's (and half of China's) timber imports from Guyana, and that India and China (primarily India) account for more than half of Guyana's log exports, entities in India and China might be unwittingly party to such fraud. The loss of export revenue attributable to transfer pricing fraud probably now amounts to very approximately US$50 million per annum. Although that amount is substantial in relation to Guyana's official export revenue of US$ 500 million (roughly half of which was then attributable to gold, diamonds and sugar, and a further 10% to timber), Guyana's losses from fraud in the export of gold and diamonds is probably much more substantial. Such a large percentage in lost revenue should prompt donors to at least claim to be applying effective pressure on the government of Guyana to substantially reduce those losses. Remarkably, donors do not seem to be doing so. Logs, sawn wood, and plywood accounted for approximately 35%, 45%, and 15% of the RWE volume of Guyana's timber exports during 2009.[-] It seems likely that an increasing proportion of the logs exported is supplied other than directly from forest concessions - by shops and other small enterprises across the country (run by Chinese immigrants or ethnic Chinese domiciled in Guyana) which, implicitly, have diversified away from the business which they are authorised to conduct. Such informal commerce is unlikely to be acceptable if and when Guyana implements a credible Voluntary Partnership Agreement "VPA" with the European Union under the latter's Forest Law Enforcement Governance and Trade "FLEGT" action plan. Top Bai

Shan Lin [-] A state-owned timber enterprise from Wuchang (Northern China) was to log Jaling's concessions despite having no experience of tropical forests. It is likely - see the next paragraph - that Guyana BaiShanLin International Forestry Development Co. might have logged Jaling's concessions. These arrangements are akin to "landlording" which is illegal in Guyana (unless officially authorised by the President). The resulting timber was to be exported through a joint venture partly owned by a Mr Chu Wenze - a hardwood floor dealer - who was chief executive of BaiShanLin and who has been arrested in China. Mr Wenze has forecast that BaiShanLin's annual output of processed timber from Guyana would exceed 300,000 cubic metres at its peak.[p5] It is said that BaiShanLin now (2010) has interests in a concession (which Barama used to log [§5]) under arrangements which include a change in underlying control of the concession (implicitly illegal unless authorised by the President). BaiShanLin (part owned by "BUCC", a (state-owned) residential housing company from Beijing whose indentured work force in Dubai went on strike during 2007) has also taken over Jaling's operations in Linden (the location of the Karlam mill). Safety for workers and visitors to those operations has been a disgrace and BaiShanLin's workforce is treated badly. There is concern that the timber businesses associated with BaiShanLin and Jaling are using chinese workers (some of whom are indentured/bonded - as in Dubai) instead of employing local counterparts - and withdrawing support for community services. BaiShanLin was registered during the month in which 51% of Jaling's shares were acquired from the Chan family. Its subsidiary, BUCC Wood, asserts that BaiShanLin has been granted wood cutting licences for 1.2 million hectares of Guyana's forest - an area considerably larger than that of concessions granted to Jaling, Garner and Demerara Timber combined... It is likely that this exaggeration was intended to increase intererst from Chinese investors - i.e. to con them. Alleged financial difficulties helped BaiShanLin to secure (from Guyana's Republic Bank) a US$200,000 mortgage over the Karlam sawmill. BaiShanLin subsequently defaulted on its repayments. The Europen Commission (under its Linden Economic Advancement Programme) has subsidised China's timber industry with a US$10 million loan [p19] to promote the export of flooring strips from a controversial sawmill in Guyana.[Karlam p23]. China can easily afford to provide such susidies itself. The enterprise in which the loan is now invested, BaiShanLin [p18], is related to the government of China. Given this and BaiShanLin's track record, it is remarkable that the European Commission continues to support this enterprise - indeed it is unlikely that BaiShanLin's products would be acceptable for import into the EU under the EC's [p9] "Timber" (due diligence) regulation. During April 2007, BaiShanLin was prohibited from exporting logs, partly as a consequence of its failure to comply with its obligations. Two weeks later, Jaling's Timber Sales Agreement was suspended due to non-compliance by whoever was then logging on behalf of Jaling. BUCC Wood, established at the end of 2006, is a jointly-owned subsidiary of BaiShanLin and BUCC. It claims to sell 200,000m3 of imported logs annually (the maximum Wuchang expected to extract from Jaling's concession) and to process some of this into veneer and flooring in Beijing. BUCC Wood gives the impression that Guyana is its sole supplier, that its logs enter China through ports near Zhangjiagang, Shanghai and perhaps Tianjin, and that at least some of the products made from those imports are subsequently exported. However, China declared the import of little more than 60,000m3 of logs and 4,000m3 of sawn wood from Guyana as a whole during 2007. BUCC Wood appears

particularly to promote logs of locust wood (Hymenaea courbaril)

from Guyana in its marketing

material. The export from Guyana of logs of this species - and

crabwood/andiroba (Carapa guianensis) which BUCC

also markets - has

been prohibited since 2002, both for reasons of conservation and

in order to safeguard supplies for Guyana's furniture industry. Authorities

in China have been obliged to "correct" the statistics of

imports from Guyana which they declare to the ITTO so as to exclude

reference to this species. BUCC Wood also

markets logs of bulletwood (Manilkara bidentata) from Guyana

- a protected

and ecologically important "keystone" species, for which

the Guyana Forestry Commission nevertheless quite readily grants

permission to log.Top Barama

(Samling Global) During early 2006, Barama (then Guyana's largest timber enterprise) received an FSC certificate pertaining to the management of 570,000ha of its forest concessions. This FSC certificate was withdrawn in January 2007 after it became apparent that Barama had failed to comply with improvements required to maintain that certificate. Of Barama's 218,000m3 log production during FY2005/6, only 28,000m3 were FSC-certified and 156,000m3 derived from the 445,000ha of forest (and a further 60,000ha or so of Amerindian lands) over which Barama claims harvesting rights. Given that Barama's 1.6mi hectare concessions expire in 2016, it is remarkable that such a small proportion of Barama's log production derives from its own concessions. However, the window of opportunity for such exploitation is short (such "rights" tend to be illegal and they expire prior to 2016), making it unlikely that management of these forest areas is sustainable. Indeed, Barama has stated that it has no intention of managing these areas sustainably [§12] (which is contrary to the law). It is probably from these areas that it fells most of thelogs which it exports. Barama is now wholly owned by Samling, its former joint owner Sunkyong (a major conglomerate from Korea) having withdrawn. Samling, based in Sarawak, is a controversial logging group (particularly due to its record for disrespecting native customary rights) which has recently been blacklisted by one of the world's largest investors - the government of Norway. Samling's listing in February 2007 on the Hong Kong Stock Exchange[code 3938] embarrassed the banks which arranged that listing. Most of Barama's key workers and labourers are Malaysians and Indonesians - some of whom are said to have worked for Rimbunan Hijau in Papua New Guinea - fuelling resentment within Guyana. Such employment practice, allegations of economic crime (concerning transfer pricing fraud and the granting of the very large area of its forest concessions and its remarkably generous tax treatment), failure to respect the rights of workers and indigenous people, and procuring wood from dubious sources, all in relation to Barama, breach "A Guide on Sustainable Overseas Forest Management and Utilization by Chinese Enterprises" - which is said to be applicable to enterprises operating from Hong Kong as well as mainland China. Subsequent to a formal review of its relationship with some officials which investigated illegal logging operations and fraud, Barama was penalised with a token fine and by having some of its operations suspended. More recently, Barama has been further fined - for failing to submit credible forest inventories and operation plans. It seems that Barama has not paid all its fines. It would appear that Barama's continued operation in Guyana - including without even having a forest management plan [CAR.SGS.FM.2006.14] - is consistent with high level corruption and the consequent risk of blackmail. If Barama, the owner of the country's only plywood mill, finds it more profitable to export logs rather than plywood then this might partly explain why Guyana's plywood exports have collapsed - and would tend to reduce management effort in the mill, causing the quality of Barama's plywood to deteriorate. Barama's ill-repute will have contributed to a reduction in buyers' interest in that plywood. That collapse might also be attributable partly to exhaustion of suitable species in Guyana's forest - reflecting unsustainable management and a failure of government oversight. The mill processed logs from numerous sources. As indicated in the table below, the volume of plywood entering end-use each year within Guyana has fluctuated around an average between 5,000 and 10,000 cubic metres. The mill was a fundamental component of the very generous investment incentives granted by the then Guyana government to Barama (Barama commenced operations in 1991). The mill seems to have been used by Barama as a political tool. Soon after being convicted for several illegalities (and perhaps in response), Barama threatened to close the mill. The reason cited - insufficient supplies of logs - (refuted by the government) implies an unwillingness to buy in suitable logs, and has previously been given (perhaps when negotiating access to concessions which it had not been granted). Given Barama's ownership by a major tropical logging group whose operations include plywood production, it would be odd if Barama had offered to build a mill whose capacity exceeded the likely supply of suitable logs and/or that it so overestimated potential log production from its own and others' concessions. However, it might have done so as a (fraudulent) tactic to secure favourable terms of engagement in Guyana. Similar tactics may explain why the Independent Technical Report prepared for the Samling Global IPO in 2007 (see below) states that there are plans to expand the mill from 108,000 to 153,000m3/a - the increase being in stark contrast to the publication a few months later of plans to close the mill, and the steep decline in production by the last decade (see table below). The government forced Barama to close its Buck Hall mill during 2010 subsequent to the death of an employee in the mill's timber shredder. Barama closed its mill for the foreseeable future during October 2010, subsequent to damage to part of the mill which had a fundamental design fault.[1.] The President has expressed willingness to renew the subsidies from which Barama has benefitted for many years despite their cost to Guyana especially if the plywood mill is reopened.[-] Barama has been subsidised by (externally supported) technical assistance [ECTF; WWF] and, for almost twenty years (as a consequence of its various tax and de facto legal exemptions), by the people of Guyana. It has been said that the set of company accounts which Barama submits to the Registrar of Companies tend to show that Barama's business is unprofitable, despite all this assistance (and its competitive advantage in relation to profitable Guyanese timber companies). Like most timber companies listed on the Hong Kong stock exchange, Samling Global is incorporated in a British Overseas Territory (Bermuda), presumably for reasons of transparency and tax efficiency. Despite the above, it would not be surprising if, prior to standing down during 2011, the President were to renew Barama's financial privileges for a further ten years. Comparison between the import statistics of China and India and Samling's export statistics[slide 36]suggests that, during 2009, Barama supplied one third of the volume of logs which were exported from Guyana to China and two thirds of that supplied to India. Samling plans to produce 220,000 cubic metres of logs during 2011,[slide 16] not much less than the total produced nationwide in Guyana during recent years.[p27] Top Vaitarna

/ Dark Forest Company (Simon and Shock; Caribbean Resouces) It is also not legal to allocate concessions to enterprises - like Dark Forest Company - which have no experience of tropical forest logging. Further, it is not legal for a concessionaire to subcontract the logging of its concession (unless authorised by the President) - as the Minister implies [ ], and even more questionable if the two concessions were to be logged by affiliates of Barama or Bai Shan Lin. The Minister responsible for forests would appear illsuited to his role given that, as Minister, he has implied that cultivating tree crop monocultures on accessible plantations requires similar experience as logging in remote, bio-diverse forest.[-] The allocation to Simon and Shock was made during January 2008 on condition that it established a major sawmill before carrying out any logging. No such investment appears to have been made. Although Dark Forest indicates that it might establish a mill, the enterprise seems intent on exporting logs (contrary to Guyana's forest and export policies) for the foreseeable future.[p2] It is unclear why the Guyana Forestry Commission has not withdrawn either the concessions acquired by Dark Forest. Having taken three years to carry out the requisite checks on the original owners of Simon and Shock (an established timber business), it is odd that the GFC does not appear to have carried out similar due diligence concerning the eligibility of this enterprise. Further, it is unclear to which CLICO policy holders the G$600mi payment on which has been made on behalf of the Coffee Day group for CRL has been allocated.[-] It transpires that Dark Forest Company is an afifliate of an Indian group whose core business is the management of cafes - Coffee Day - which seeks to expand its (currently in-house) furniture business, DAFFCO. Its plans to do so and float DAFFCO will presumably benefit from investments made during April 2010 by the private equity funds of Standard Chartered and KKR.[-] Perhaps these funds and those involved in promoting the flotation (including the relevant stock exchange) are unaware of or have discounted the reputational risk to which they are or will be exposed given the probable illegality of the furniture which DAFFCO presumably intends to make from wood supplied by its logging business in Guyana - a business which would seem to belie and threaten the integrity which underpins Coffee Day's brand. DAFFCO closed during 2019 (the business - allegedly including linked to questionable practices - being in financial difficulty, and its proprietor having died).[-] Presumably Vaitarma's concession will revert to the state.[-] It appears that the authorities have waived the requirement that Vaitarna establishes a saw mill[-][-] and, for reasons which are not yet clear, the company has requested that its concession agreement be transfered to an affiliate of almost the same name[-]. It is understood that the company has started to export logs from Guyana. Top Demerara

Timbers BaiShanLin (see above) has an agreement with Demerara Timbers inter alia to assist in marketing, upgrading the equipment of the latter's saw mills at Mabura and broadening the range of products which it manufactures, and now appears now to admit[slide 6]that it controls Demerara Timbers. Demerara Timber has an associate company (named Rich Resources) which rents a Guyanese-owned concession - which is illegal unless it has the explicit approval of the President. Demerara Timbers' own concessions total 552,000ha. SK Chan is understood to have seized control of Guyana's Forest Products Association in order to use this as a front to lobby the government. A particular concern is his plan for government to rescind all underperforming concessions (/"Timber Sales Agreements" - annual access to which are currently "negotiated" with the Guyana Forestry Commission instead of being under contract for 25-years as required by law) to a foundation which will control and sub-let viable areas for logging. Given the supposed unprofitability of the timber businesses which Mr Chan has operated in Guyana, it would be remarkable if those areas would be logged to the benefit of Guyana. Top Jaling

and Garner (China Timber Resources) Perhaps coincidentally, a Mr Liu Feng Lei was a major shareholder in Seapower Resources at the time when another Mr Chan (Chan Chun Hing / Kenneth Chan) was the company's financially controversial chief executive and principal owner. Prior to acquiring Jaling and Garner, Seapower made an arrangement with the government of Guyana to explore for and exploit petroleum, natural gas and mineral resources in Guyana.[p14]. Perhaps coincidentally, China Timber appointed to its Board of Directors Neil Bush, a member of the family of two recent Presidents of the USA who has been Director also of an enterprise managed by a son of Jiang Zemin, a former President of China. Top Sherwood

Forrest A partly Malaysian enterprise UNAMCO has been obliged to leave its former concession (TSA) in the same region as Sherwood Forrest, having failed to comply with the terms of its concession. Top |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

* includes change in stocks |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Declared imports of logs from Guyana (by China)

Source (China): General Administration of Customs

of the People's Republic of China |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Copyright

globaltimber.org.uk

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||