|

Wood pellets (for fuel)

Click

here

for charts illustrating each EU member state's monthly imports and

exports of wood pellets.

Click

here for a related commentary on EU member states' trade in wood

pellets.

Click

here for a summary of the share

price performance of

Drax and

Enviva Biomass.

Click

here for charts which illustrate

trade in methane

Global production, imports and exports

Sources based on:

[Production] FAOSTAT; [Imports and Exports]

official national statistics and UN Comtrade (footnote

2)

Three countries and the EU account for almost all imports, three countries outside the EU supplied almost all those (2023) imports. Three countries and the EU produced a large majority of the 2023 world total

- and exported almost all their production. The market is

clearly geographically narrow. It is also dependent on a single

sector - except in Japan, a small number of power stations (typically

large and formerly coal-fired) burn imported wood pellets to generate

subsidies. Data for 2024 suggest that the market has peaked -

even in Japan. Industrial markets - which would not be

subsidised - are unlikely to convert from fossil fuel to wood pellets,

or to use pellets as a raw material for chemicals. Others take a

different view - for example

here (page 11).

Enviva's bankruptcy demonstrates how risky

investment in production is. With costs rising and the

industry's claims to be a climate panacea increasingly recognised as

bogus, including within government, Enviva's

rebirth

may be short-lived.

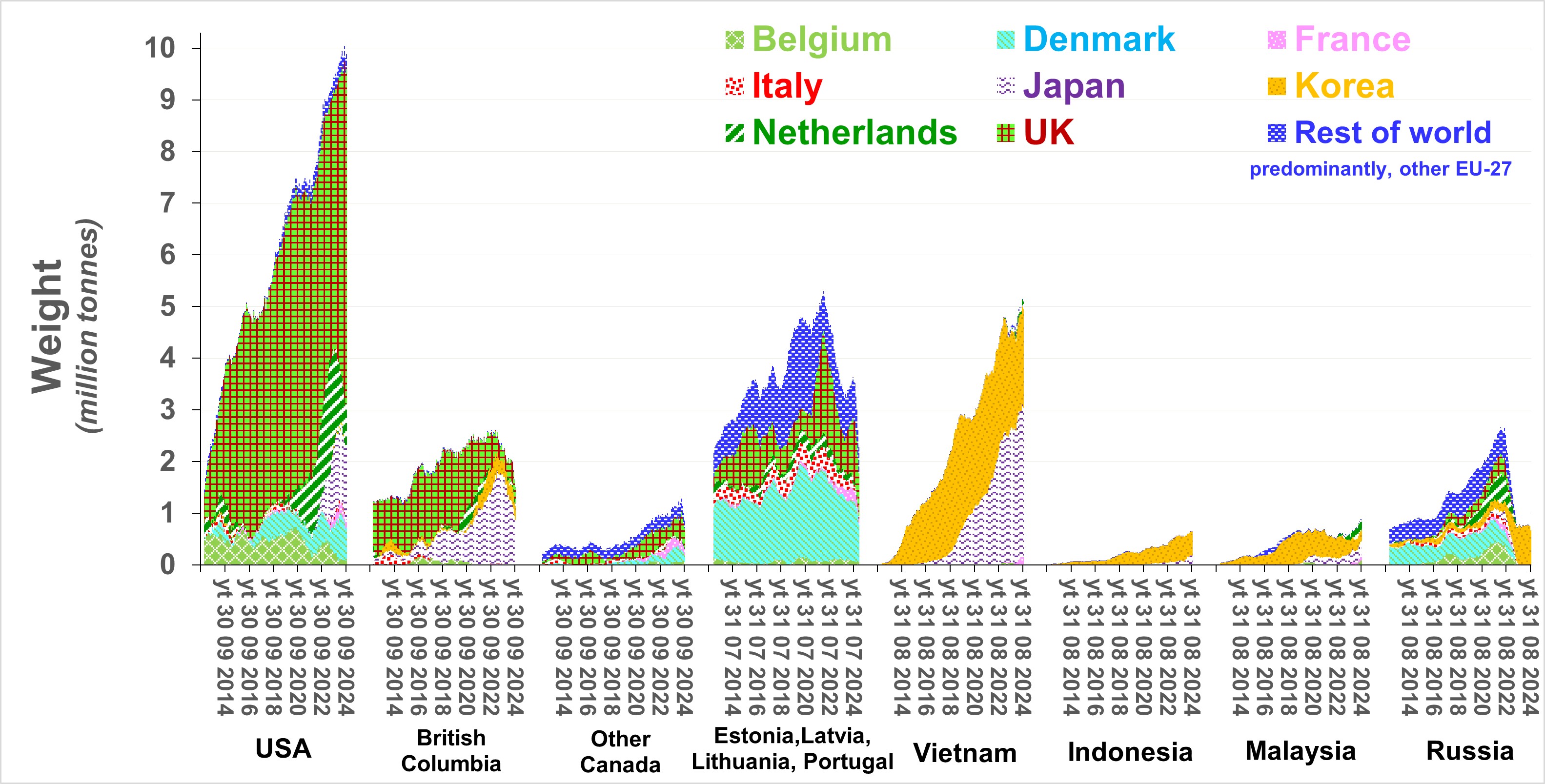

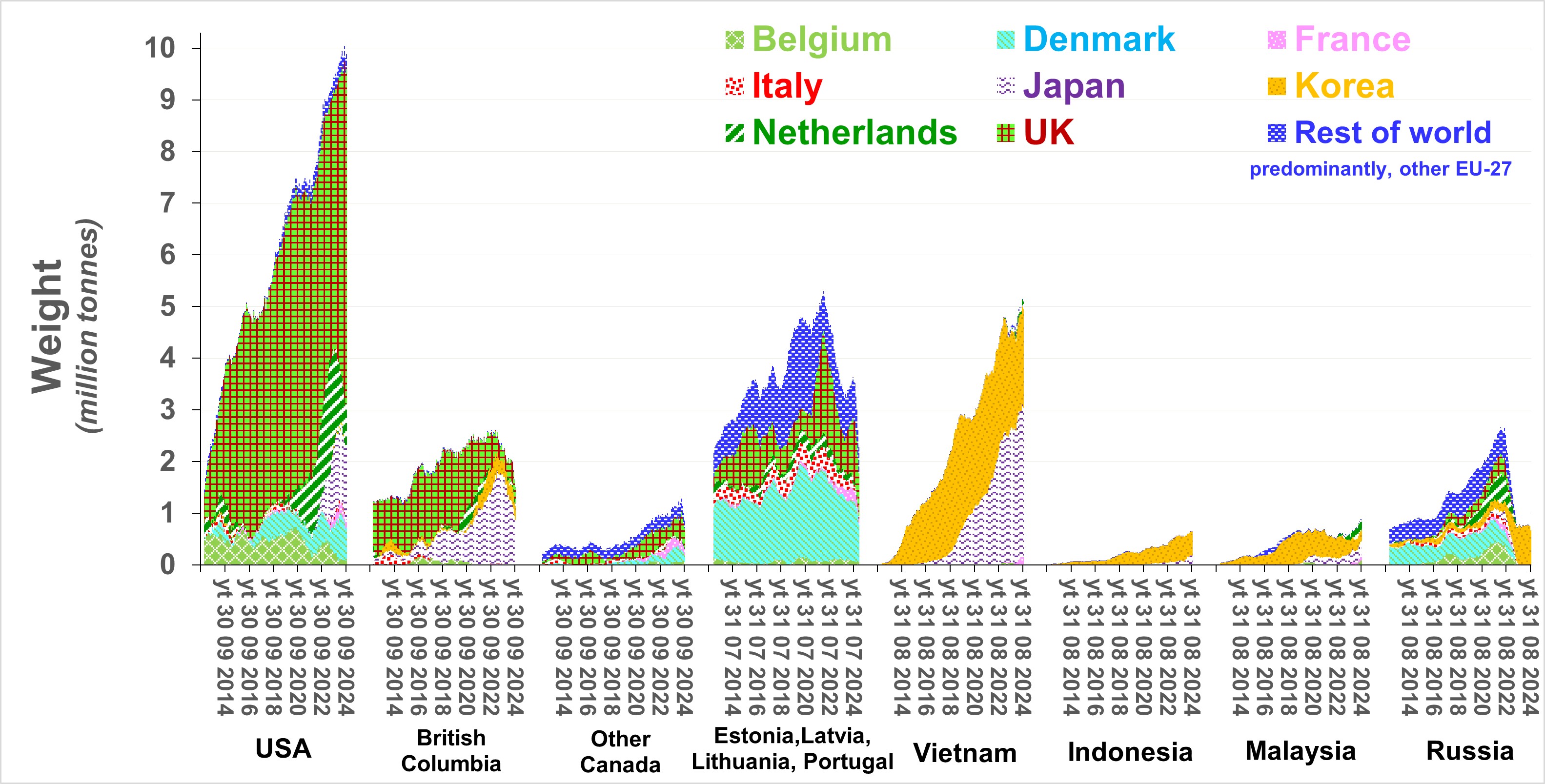

Exporting countries' exports by destination

(Based on various official

sources [Footnote

2])

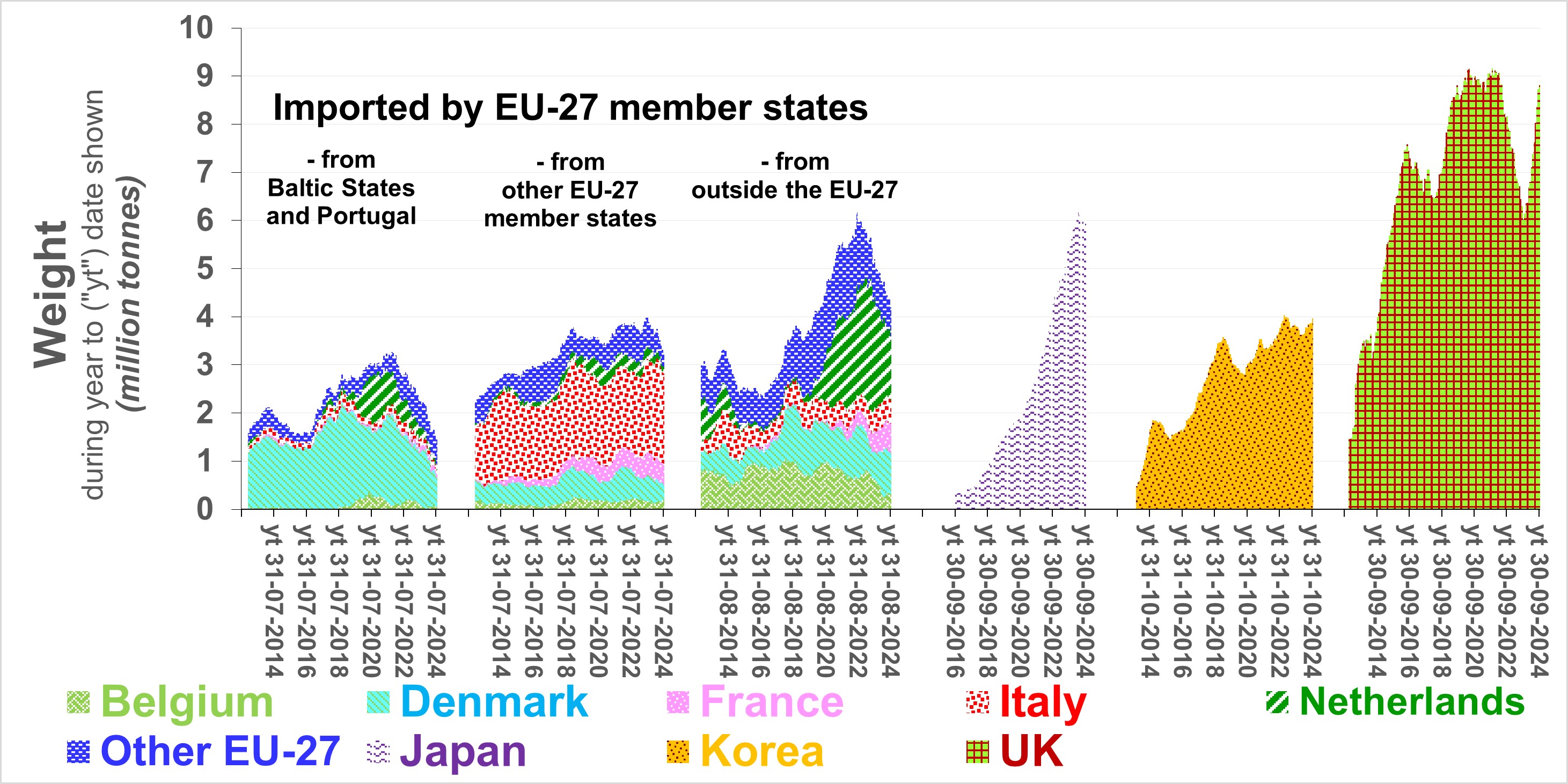

Importing countries'

imports (Based on various

official sources [Footnote

2]) Importing countries'

imports (Based on various

official sources [Footnote

2])

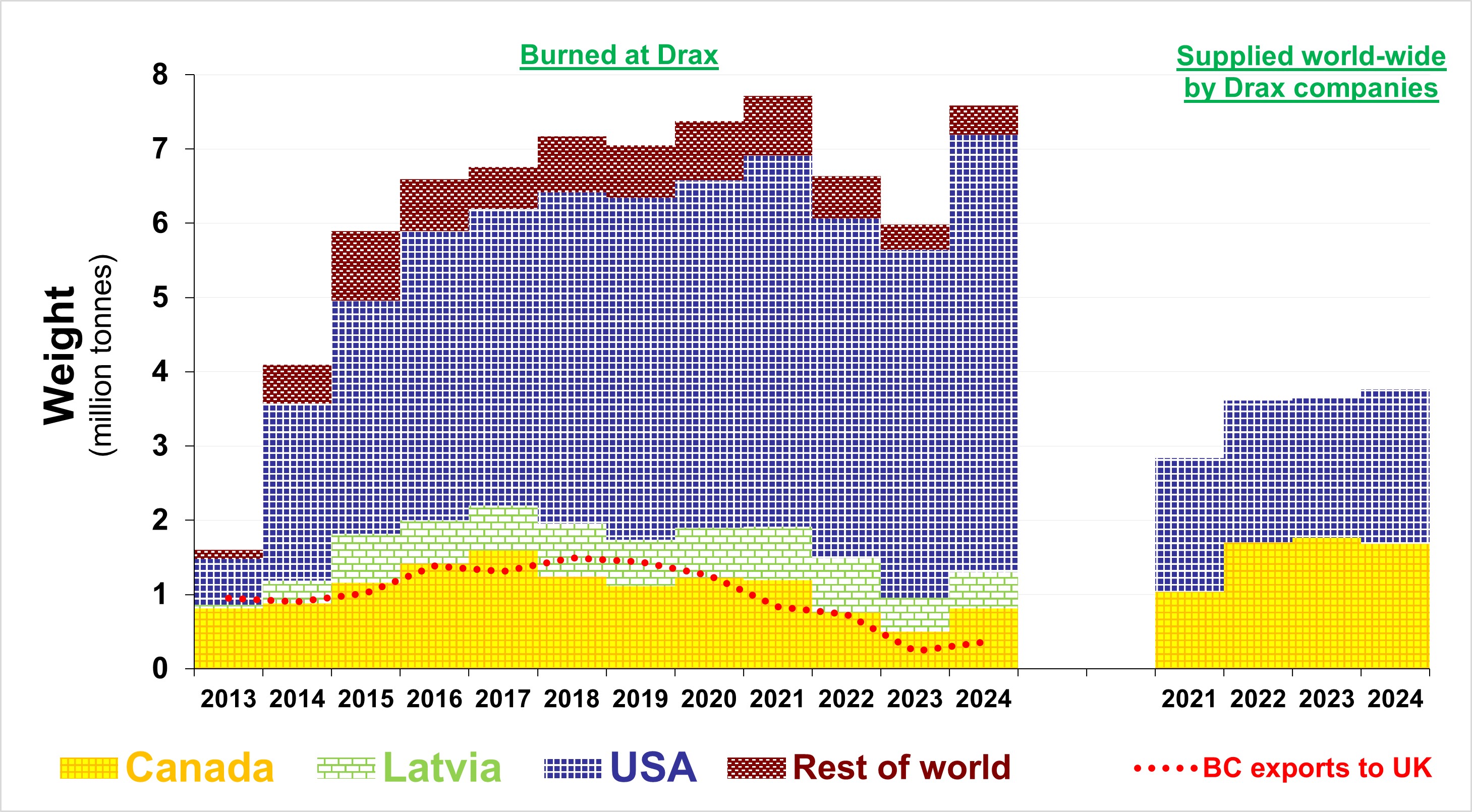

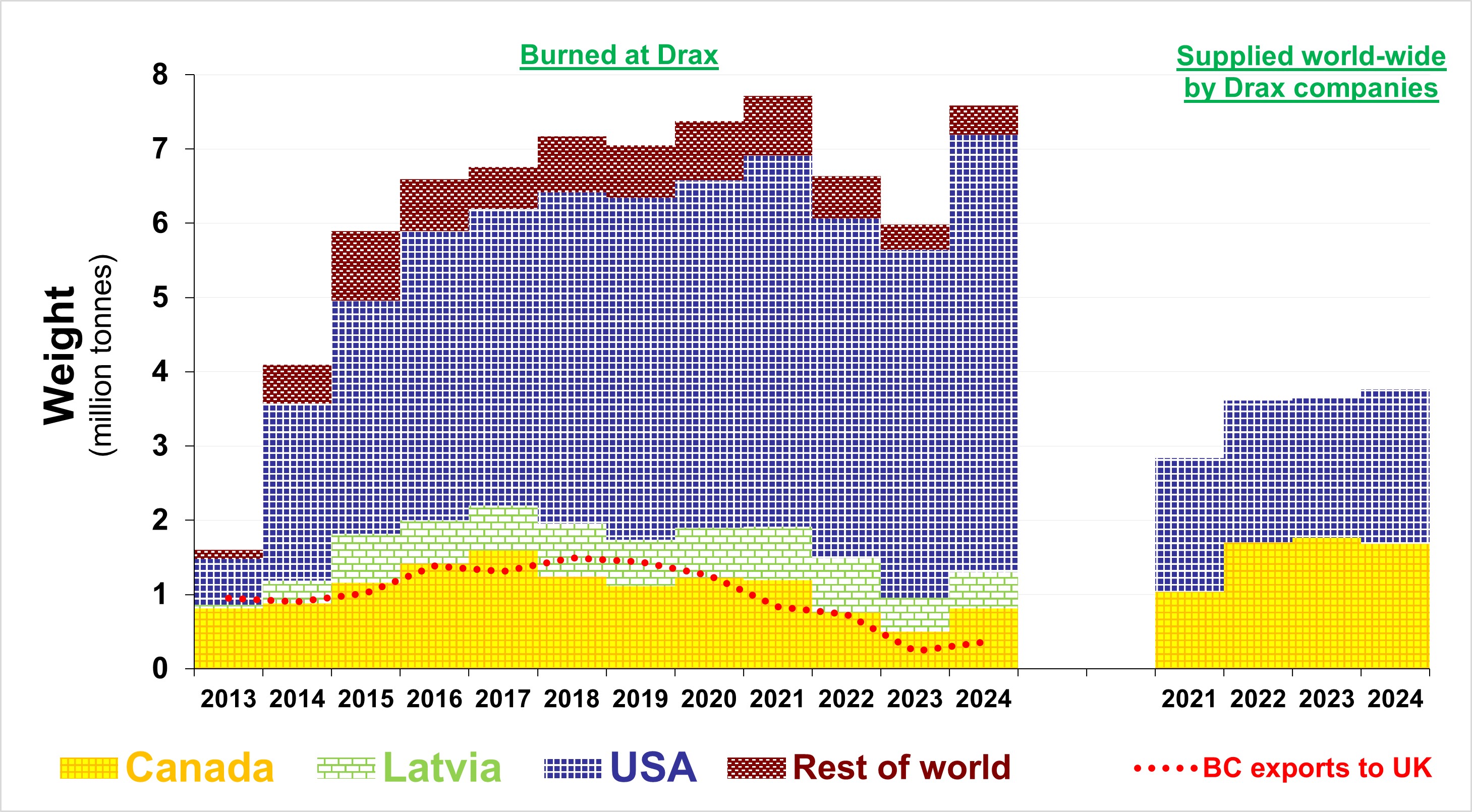

Drax' biomass feedstock

Source: based on

Drax plc Annual Reports (various years).

5.8 million tonnes of imported wood pellets burned at Drax

during 2023

Note

1: "low grade roundwood" may be a euphemism for logs from trees

of no commercial interest to sawmills, perhaps deriving from clear felling (self-evidently unsustainable).

This proportion supplied under this category is increasing.

Note 2: "sawdust and saw mill residues" might include roundwood delivered to a sawmill which the mill does not transform.

Sawmilling and related clear felling and thinning would be less

commercially viable if pellet mills do not procure this category of

feedstock. The carbon emissions associated with this should be

attributed to the pellets, pro rata, based on weight of

sawmill output

(not commecial

value).

Latvia is a leading supplioer of sawnwood to the

UK and the UK is a leading destination for Latvia's exports of

sawnwoood.

As such, the UK is a leading contributor to Latvia's

forest land becoming a net carbon source.

Increasing the amount

of logging (implicitly cleaf-felling) to supply feedstock for the

pellets from Latvia burned at Drax compounds this.

No

compensation is yet paid by the UK (or Drax) for the net amount of

sequestration and other carbon which is foregone or lost over the

lifecycle of the affected forest.

Wood pellets supplied by Drax companies

versus what is burned at Drax

Source: based on

Drax plc Annual Reports (various years).

Time

lags aside, between 2013 and 2022, the weight burned at Drax has

matched the weight which Canada's export statistics indicate were

exported to the UK from British Columbia (the province from which

Drax' supplies to markets world-side are likely to derive). In 2023

those exports from British Columbia amount to roughly half the amount

from Canada burned at Drax. Drax

suggest

that the proportion of its pellet production for world-wide markets

burned at Drax is small enough to justify accounting

for those

burned at Drax at the market price - not cost. This would tend

to minimise taxable profit and help increase the CfDe strike price it

secures if, perhaps contary to publiuc interest, Drax' business continues "come

what may". The UK government has

offered Drax a CfD, within constraints (below full capacity), to

support the burning of imported wood pellets at Drax power station

from (aptly) April Fool's Day 2027 to 31 03 2031

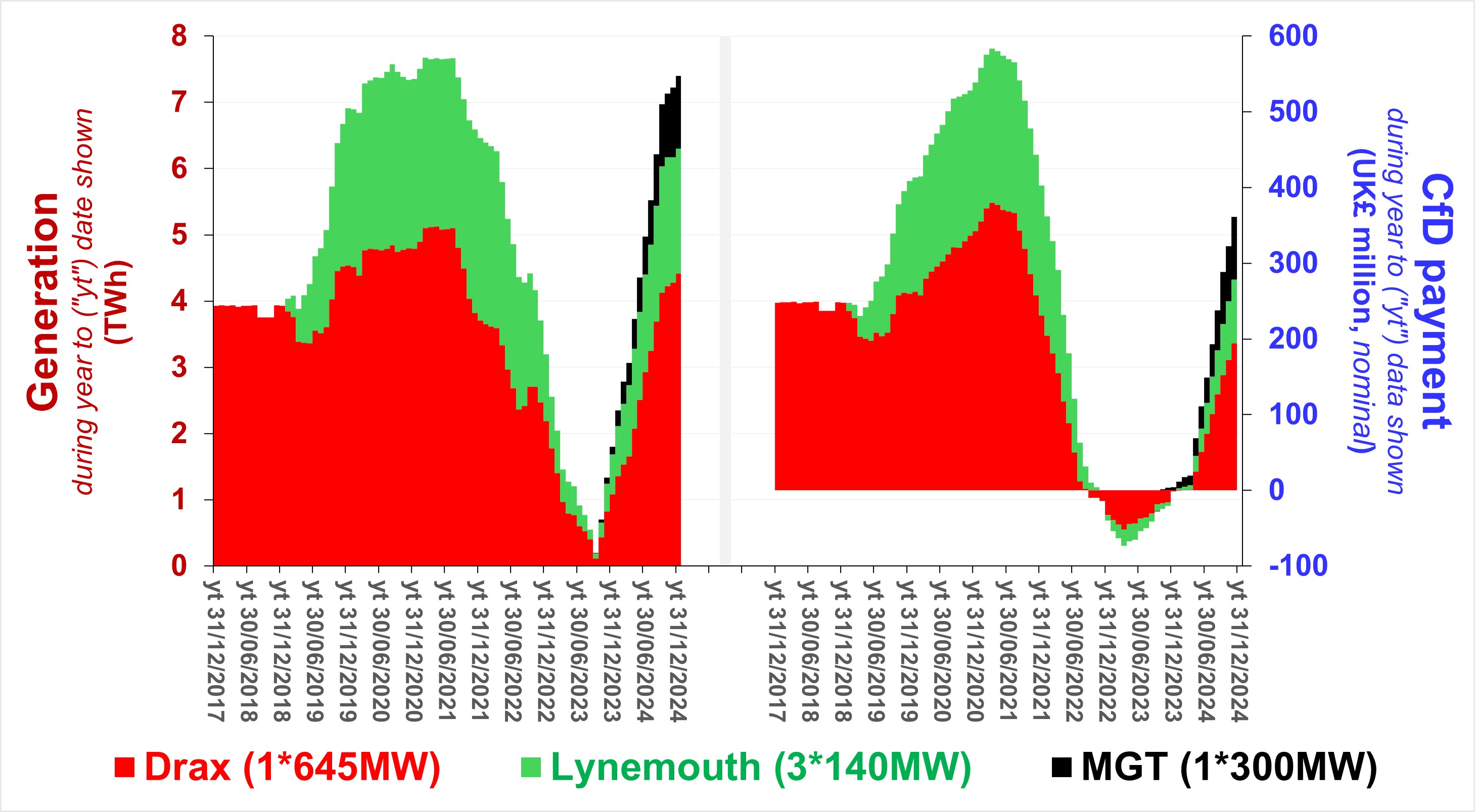

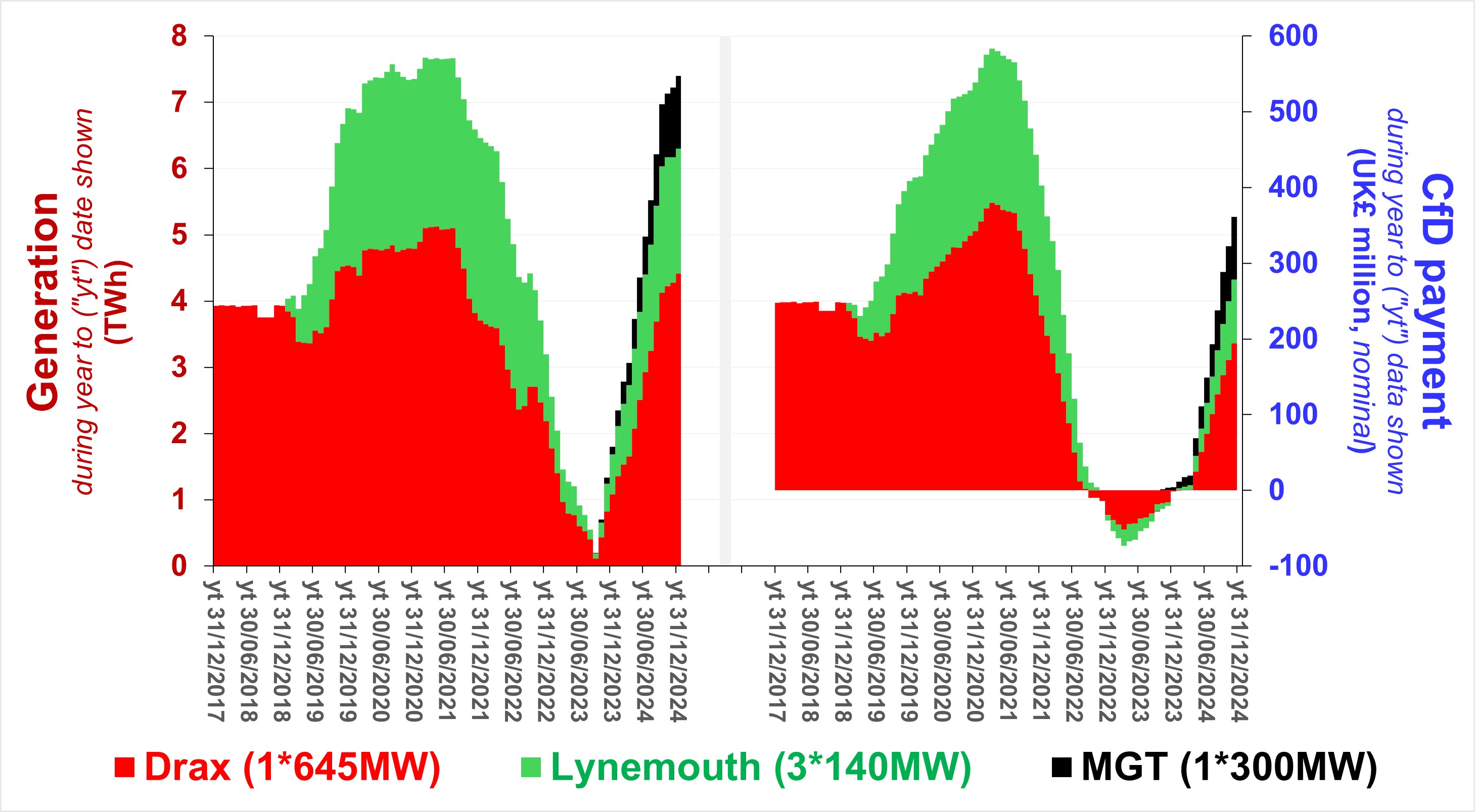

CfD-subsidised power generation at times of

great national need

Source: based on

Low Carbon Conracts Company.(to end

November 2025)

Rather than address national

need, CfD contracts negotiated with large generators for burning wood

allowed and implicitly encouraged those generators to cease using

their CfD-subsidised units, maximise their returns instead. Is

their heart really in decarbonisation of the UK power grid and the

climate emergency? Does it jeopardise their proposals to capture

post-combustion CO2?

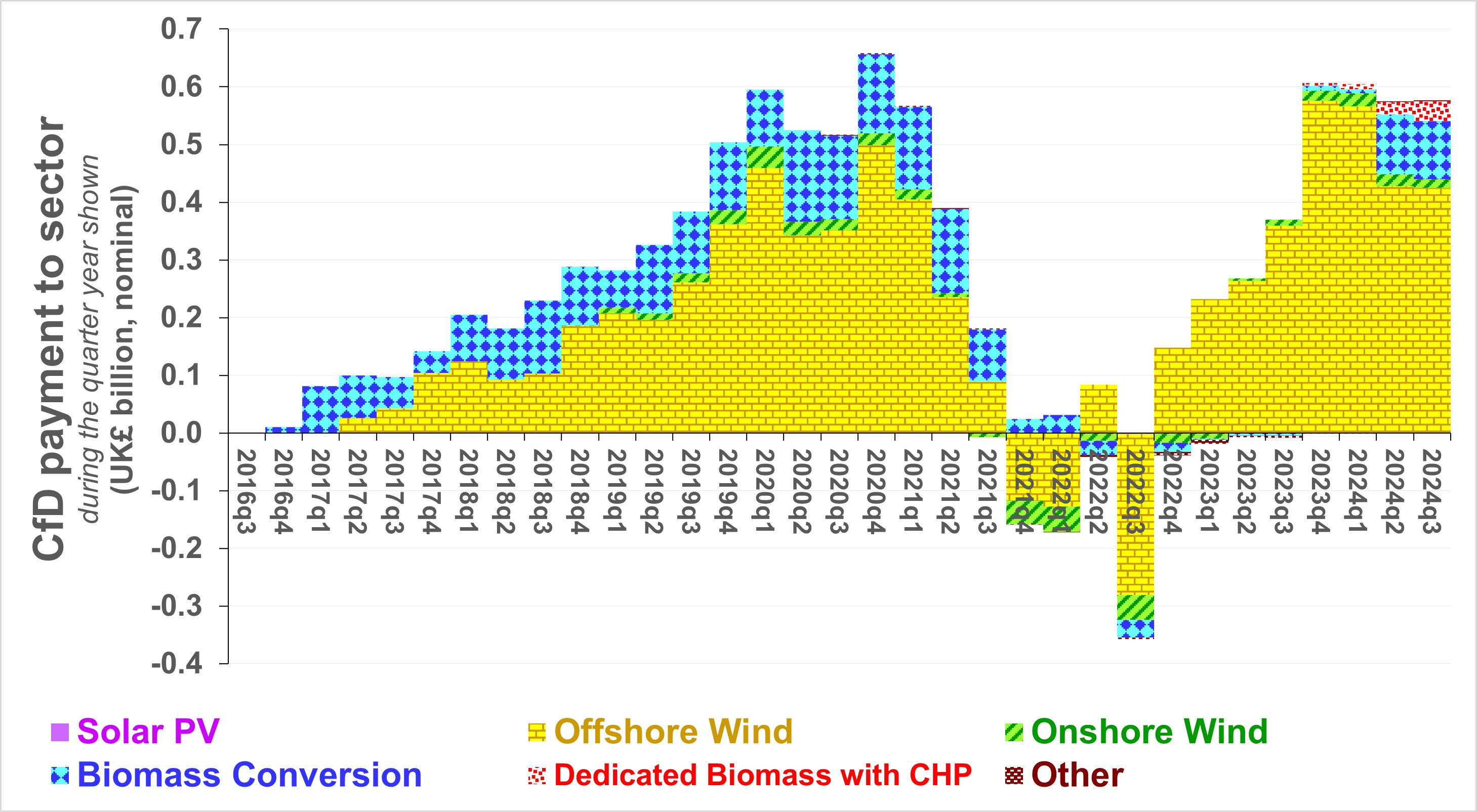

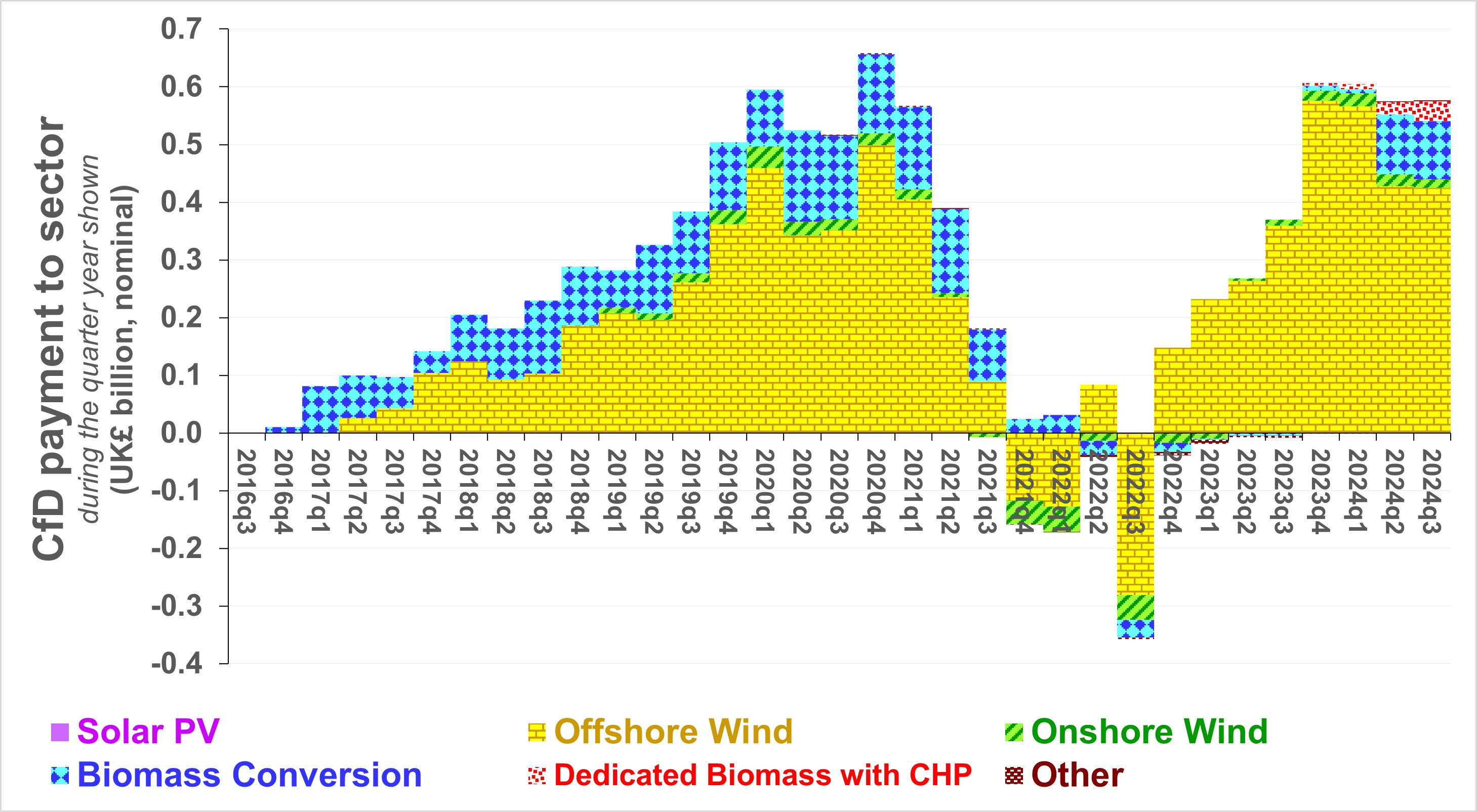

Contracts for Difference payments to each sector

(Based on

Low

Carbon Contracts Company)

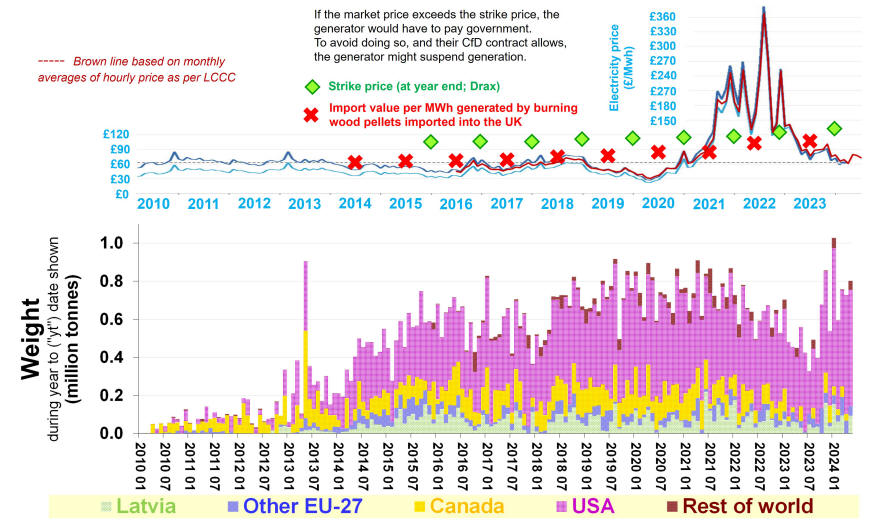

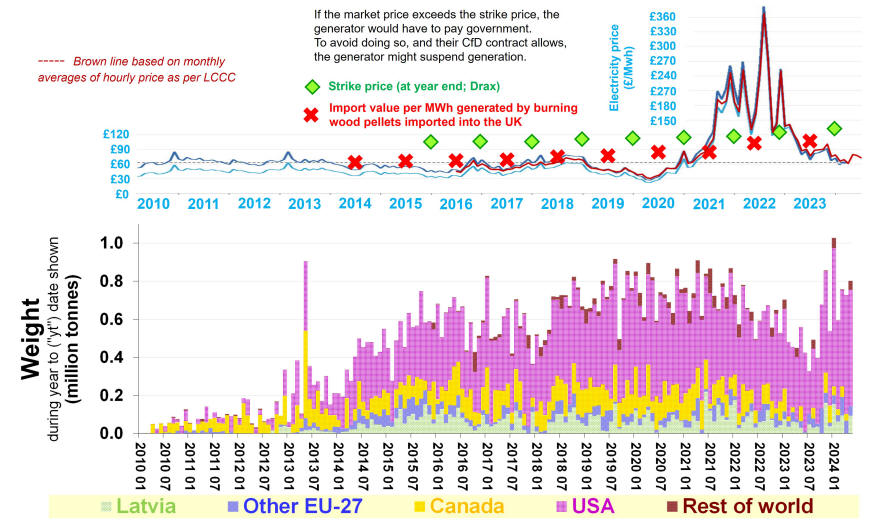

UK imports of pellets compared with UK

electricity prices

Source: [imports] based on Eurostat and

UK Trade Info

(to June 2024); Drax annual reports;

[electricity prices]

Low Carbon Contracts Company (from

31 07 2016)

Electric Insights Q1 2024 (01 01 2010 to 31 03 2024)

Weak regulation of CfD subsidies? Pellet burners (and, if incentivised

by remuneration strategy, senior executives) profiting by

generating less when prices are high - thereby worsening price spikes for

electricity (and, in turn, methane), prompting reduced heat and power

use by the poor? Almost all burned at Drax and EPH Lynemouth to

generate subsidies & to pretend zero CO2 emissions?

Does this indicate that their owners are of insufficient character to

partner with the UK in Net Zero?

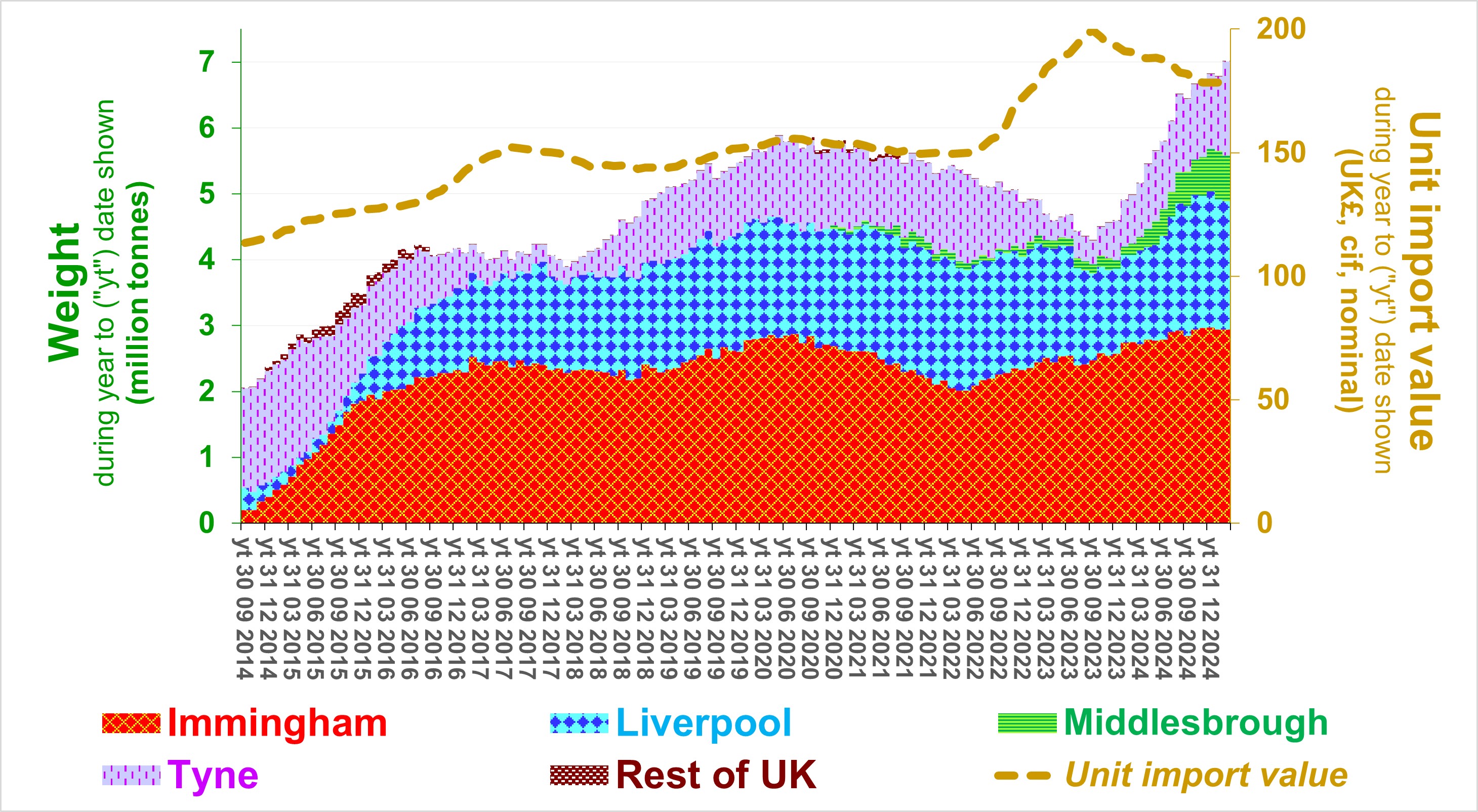

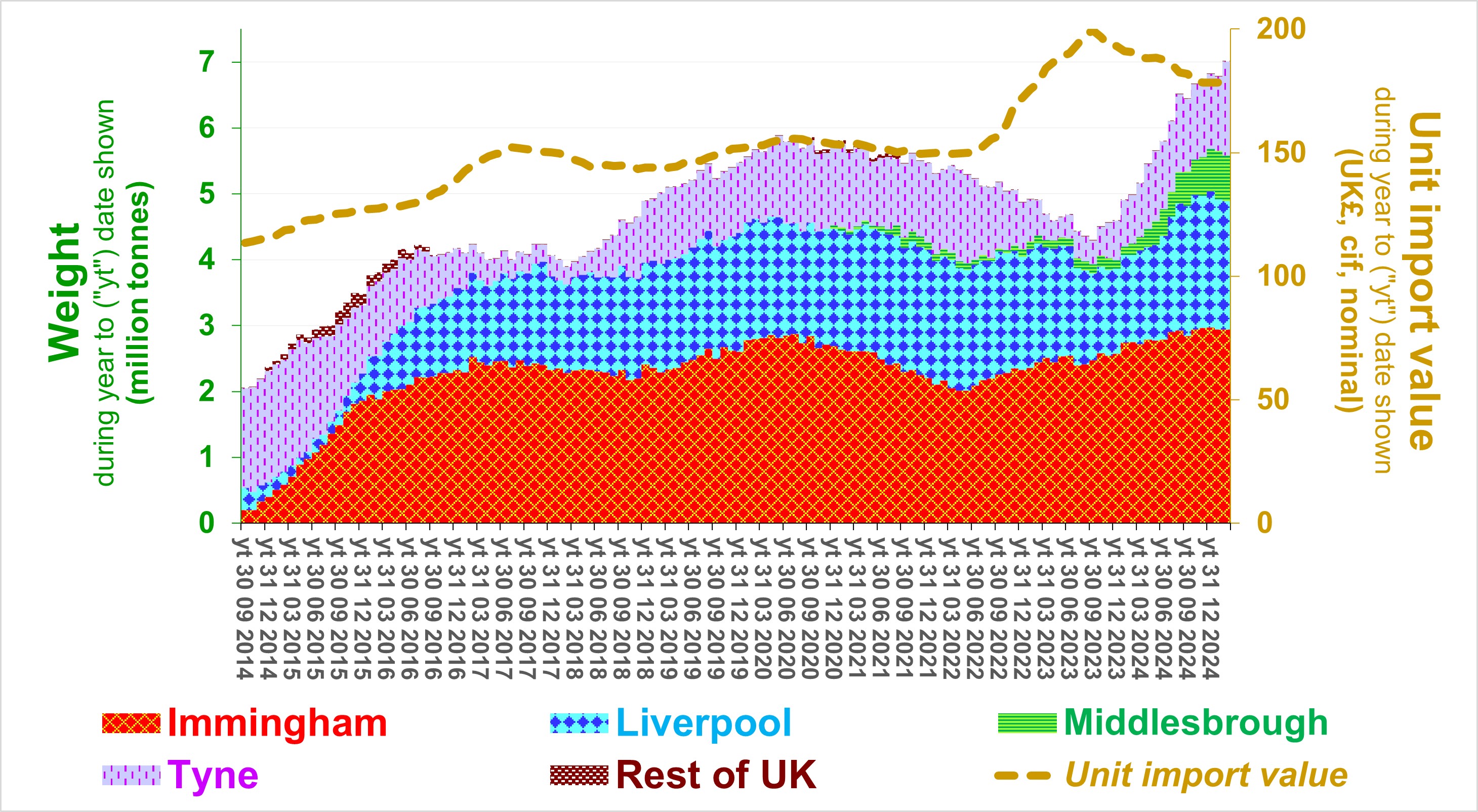

UK imports of pellets from USA, weight by port

and unit import value

Source: based on

UK Trade Info

(up to 30 06 2025)

Import value per unit of weight

will vary with the mix of long-term, contracted supplies and purchases

(some speculative) on the spot market (spot prices rose steeply during

autumn 2022).

The increase in imports reflects MGT Teesside starting

to

generate electricity and the restart of

CfD-subsidised generating units at Drax and Lynemouth (whose operation

was curtailed

for prolonged periods of peak demand between 2022 and

2023).

The port of Tyne supplies up to

100% of the wood pellets which EPH Lynemouth burns - to generate

subsidies - perhaps

30,000 tonnes per week or

1.4 million tonnes per year (from 2018)

Unit

value of pellets exported from USA during spot market hiatus

Source: based on USITC Trade DataWeb

successive 12-monthy periods - 2021 to 31 10 2025

"Energy security" would tend

to have deteriorated due to the hiatus in spot market prices and

corresponding subsidy payments. The hiatus may have also

revealed the fragility of the market and corporate behaviour - as

Enviva admits in its Q3 2023 report, pellet trade contracts made at

that time might contribute to its bankruptcy. The trend shown in

the chart is upwards, jeopardising prospects for continuted subsidy. Cost cutting will tend to further erode the false veneer that regional

certification confirms sustainability and that, crucially,

burning woody biomass is

carbon neutral. UK Contracts for Difference

purportedly seek long-term decreases in price of energy delivered -

yet they seem to have risen 30% (reflecting the increase in unit

export value from $140 to $180 per tonne).

USA's exports - by customs district

(to 31 10 2025)

Source: based on USITC

Trade Dataweb (code 440131) and Drax plc publications.

Exports to all major markets except

UK in decline? UK (with c75% market share) will peak soon, as

and when all units of Drax,

Lynemouth and MGT Teesside are operating at high load factors again.

The

2022-2023 decline in exports to the UK reflects a loophole in CfD

subsidies. Instead of dispatching electricity to help overcome

shortages of methane ("natural gas") and thereby minimise acute

hardship amongst people unable to pay a surge in prices for gas and

electricity, all three biomass burning power stations did not operate

their CfD-subsidised generating units when market prices exceeded

the strike price (obliging their owners to pay government the excess

revenue the owners received).

One customer - Drax - in one country - UK - has burned most of the USA's

exports of wood pellets (and, despite a decade or so since

conversion, still heavily dependent on subsidies). Exports to Netherlands

rose and fell in step with government support. Belgium has

ceased support. Denmark's suport assumes - rashly - that

post-combustion CO2 at pellet-fired units of two power stations will

perform as proposed at a cost which will be readily accomodated (and

that that CO2 wil be permanently disposed of in Norway); Exports to Japan

are increasing rapidly - Japan copying ill-motivated UK and EU

subsidy policy. UK support has sginificantly cooled - being

offered to Drax for four years beyond the term of its current

subsidies because the cost of doing so is deemed less than reliance

on gas-fired power. This reflects recognition that burning

wood pellets (whether or not imported) has unacceptable climate

implications - and the advice of the Climate Change Committee [page

14].

The customs district of Charlotte became the customs

district of Wilmington from 01 2025.

A "regional

risk assessment" of land-use in private forests covering states in (southastern) USA was published during 2025. This

(and relaxation of regulations covering US National Forest) would have potential to influence the certification scheme which seems to serve as the de facto threshold for UK government subsidy. To be

more than box-ticking exercises, it and

other assessments and public consultations should presumably

actively seek and take fully into account input from local

stakeholders and civil society groups. There is concern about

the management of forest tracts from which feedstock for certified

pellets derive. A

class action law suit is being prepared in response to air

quality violations in the vicinity of a pellet mill. Although

many such violations have been reported for pellet mills in both

Canada and USA, these do not seem to be reflected in subsidy

eligibility criteria.

Exports

of pellets from the USA - customs distrtict by destination Exports

of pellets from the USA - customs distrtict by destination

Source: based on USITC Trade DataWeb

successive 12-monthy periods - 2021 to 31 10 2025

Rate of clear-felling (/ loss of sequestered carbon)

rising fastest in Louisiana & Georgia?

Enviva (Southampton, VA) problems? Exports to leading markets in Europe

declining.

Who is burning US pellets in "France"?

"GMR" refers to Guadeloupe, Martinique and Reunion (French

territories). Albioma burns wood pellets in those territories.

"Peak pellets?"

- weight exported via most customs district either declining or at a

plateau.

Canada's exports

(to 31 10 2025)

Source: based on

Statistics

Canada (code 440131) (April and May 2024 exports to UK from BC

identical - an error?)

Is the 20%

fall in exports from BC a response to allegations about the origin

of pellets there?

The triumph of ambition (remuneration incentives

and the need to convey the appearance of momentum) over due diligence

- Drax' acquisition

of Pinnacle and subsequent expansion in BC? The steep decline in

exports from BC to UK reflects greater profit available to Drax

under its contracts with markets in Japan, than supplying Drax

power station from BC. This suggests that Drax (which

dominates pellets supply in BC, and Alberta) has a substantial competitive

advantage over Enviva in supplying those markets. During

2024, Drax

supplied almost 1.5 million

tonnes of pellets from Canada

to countries other than the UK

. Increasing costs due to wildfire (in part a consequence of

the unsustainability of supposedly sustainable forest management

practices) undermine prospects for exports of pellets from British Columbia.

Canada's exports of sawnwood

of coniferous species

(to 31 08 2025)

Source: based on

Statistics

Canada (code 4407.1x.xx)

This chart illustrates the decline in

availability of sawmilling residues (30% since Drax acquired

Pinnacle (04 2021). Such residues are said to be the predominant

raw material in the pellets which Drax exports from British

Columbia. The pellet industry helps sustain the commercial

viability of sawmilling industries (implicitly compounding

forest-degradationa and foregone sequestration).

Canada's exports of pellets

to the UK, by province

(to 31 08 2025)

Source: based on

Statistics

Canada (code 4401.31)

Grand Valley Pellets is a leading producer of pellets in New

Brunswick; its feedstock is from

JD Irving

sawmills; it is represented on the

Standards Committee of the Sustainable Biomass Program.

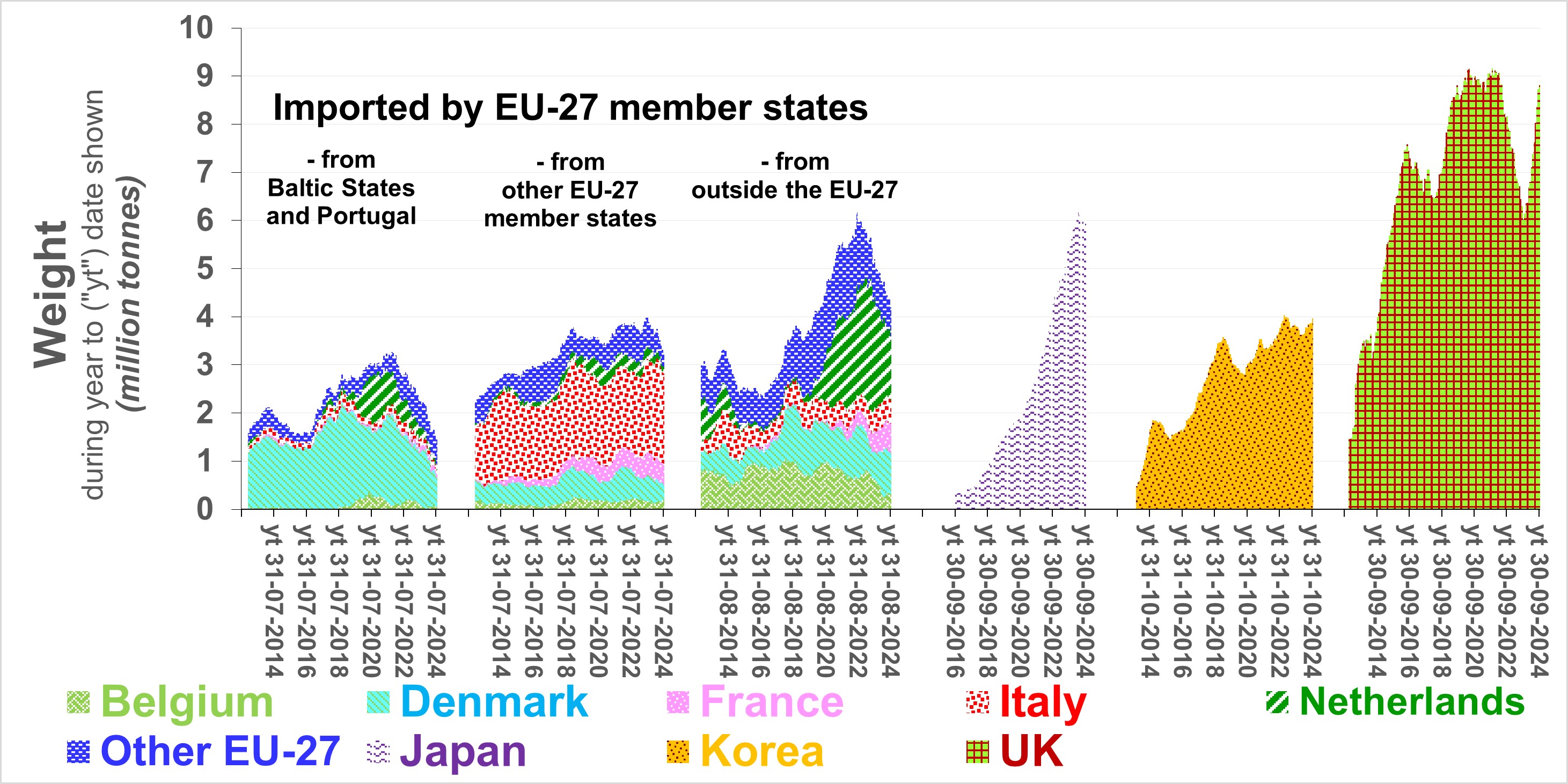

EU-27 imports of pellets (& other HS4401 customs

code products)

(to 31 10 2025)

Source (based on): Eurostat

Bans against imports from Russia and Belarus helped reduce

the impact of EU27 consumption outside the EU. EU27 pellet

imports are now largely dependent on contested imports from USA,

notably Enviva (about which,

post-bankruptcy, there is a lack of market information).

Malaysia, Thailnd and Vietnam comprise most of "Other non EU-27"

imports of pellets, the great majority being imported through

France and the Netherlands.

Japan's

monthly imports

Source: based on

Trade Statistics of Japan

(code 44013100) [01 01 2016 to 30 11 2025]

Heavily

dependent on a single supplying country - Viet Nam. The

increase in Japan's imports might reflect efforts to lock in

subsidies for new large power stations before these cease being

available

(commencing January 2026) and the dumping of excess feedstock

produced speculatively for export to pulp mills in China (and

perhaps Laos). Japan's risng share of Vietnam's exports

(already 70%) should be a worry for Vietnam's growers..

Republic

of Korea's imports

Source: based on

Korea

Customs Service (code 440131) -

to 31 12 2025

Note

step-change increase in 2022 imports from Russia. The

flat current overall trend reflects the near universal contraction

in subsidies for burning of imported wood pellets. This may

correspondingly dampen enthusiasm for wood pellet-fuelled energy.

Korea is

a world leader in

deciding to reduce support for use of wood as power station

fuel, despite seeming to condone accelerating increases in wood pellet imports from

Indonesia.

Republic

of Korea's imports

(- import value per unit of weight)

Source: based on

Korea

Customs Service (code 440131) -

to 30 11 2025

Note large price premium for pellets from Canada.

Taiwan's imports (- import value per unit of weight)

Source: based on

CPT Single Window - Statistics

Database Query (code 440131) -

to 30 03 2025

Interest has slumped, despite efforts by leading pellet

suppliers. The import value per unit

of weight of German pellets greatly exceeds that of pellets from Asia

- perhaps reflecting a need for quaity.

EU-27 pellet production

Source: based on

FAOSTAT

The chart above ilustrates

that production in the EU has peaked (implying an insufficiency of

viable woodland). The comprehensiveness of the data supplied

to or estimated by the FAO is unclear.

EU-27 - pellet consumption

Source: based on

FAOSTAT

(production) and

Eurostat (trade)

The FAO has provided estimates for a

number of (typically recent) years' production in several EU member states.

Growth in use of pellets within several EU member states has

halted or is in reverse (especially for power). Spain accounted for roughly 20% of "Other EU-27"

in 2024.

Estonia's exports of pellets, wood fuel, chips and wood residues

Source: based on

Eurostat (CN8, monthly, codes 440131, 44011*, 44012*, other

4401*) to 31 08 2025

Remarks:

Ørsted's Asnæs CHP station started burning chips

during 2020

Latvia's exports of pellets, wood fuel, chips and wood residues

Source: based on

Eurostat (CN8, monthly,

codes 440131,

44011*, 44012*, other 4401*) to 31 08 2025

Denmark's exports of pellets, wood fuel, chips and wood residues

Source: based on

Eurostat (CN8, monthly,

codes 440131,

44011*, 44012*, other 4401*) to 31 07 2025

Remarks: the great majority of the pellets reported as exports

by Denmark are probably re-exports, not least

because the leading destination countries for those pellets report

negligble quantities of pellets as imports from Denmark (home to a

leading trader).

Wood pellets

One of the EU's leading suppliers of wood pellets has recently been

declared bankrupt and there are allegations that its interests in

pellet manufacturing in the USA were fraudulent.[-]

The group's bankruptcy jeopardised proposals to convert the Langerloo

power station (in Belgium) to use biomass fuel (which has now ceased

burning coal[-]

until that power station was acquired by Graanul Invest (based in

Estonia), which claims

to be the biggest producer of wood pellets in Europe.[-]

There is little public information about the ownership and financing

of the group. The group indicates that its pellets derive from the

by-products of saw mills in Estonia, Latvia and Lithuania.[-]

The discrepancy between the weight of pellets exported to the UK

from Latvia and the weight of pellets imported by the UK from Latvia

is sufficiently large and persistent to warrant explanation by Drax and the SBP (which,

being largely controlled by Drax and major

electricity generating companies, has a clear conflict of interest as

a scheme which certifies its owners supplies of pellets). The

discrepancy also warrants liason between the customs services of

Latvia and the UK, and their compatriots in Competent Authorities under the EU's "Timber Regulation" (given

that fraud might be a leading explanation). None of the Baltic States

imports substantial quantities of wood pellets from Russia

and/or Belarus.

One of the power stations which have been awarded large subsidies

from the UK government[Slide

6] has yet to be built. Its main contractor[-][-]

is currently subject to bankruptcy proceedings[-]

This will presumably delay[-]

not only the project's financial close[-][-],

but also the commencement of construction (now expected Q2 2017[-]).

The contractor's bankruptcy would have jeopardises the proposed

construction of a 215MW power station in Belgium, but a replacement

contractor has been appointed.[-][-].

The sole supplier of wood pellets to that power station[search

term MGT] would seem to be linked to an enterprise against which a

formal complaint has been made to the USA's Securities and Exchange

Commission[-].

That complaint alleges misrepresentation of evidence provided to

investors.

According to a

statement by its

developer, greenhouse gas emissions of the Teesside power station are capped at

a level roughly five times less than those of a coal-fired power

station of the same capacity. This is so unlikely that investors

and officials should question why that statement has been made.

Given that the power station's fuel, wood (in the form of pellets

and/or chips) emits at least as much CO2

on combustion as coal per unit of calorific value, such a cap on its

emissions would implicitly cap the power station's output, in turn

capping the power station's potential revenue to roughly five times

less than if it were coal-fired.

The developer also states that

the power station will save a substantial quantity of CO2

during its life,[-]

as does its financial adivser[footnote

ii].

However, power stations do not sequester CO2

and sustaining cheap electricity supplies tends to promote consumption

(- typically and for the time being, of products having a

signigificant greenhouse gas footprint). Further, as is the

convention amongst those who promote the generation of electricity

from biomass, that purported saving assumes that biomass burned in

power stations does not emit CO2.

The requirement that its wood fuel will derive from sources which

are sustainably managed will severely constrain the supply of that

fuel. Very little woodland in south eastern USA is certified as

being sustainably managed. Given that the structure of woodland

ownership is highly fragmented and given that owners are subject to

minimal regulation - particularly in relation to sustaining the nature

of that land - there is little assurance that certified woodland will

remain eligible (and there is a risk that if that woodland is not

already a plantation, it will be cleared in order to become one,

fundamentally changing the nature of that land).

Suggested

reading:

"Burning

wood from Southern US forests to generate electricity in Europe"

(letter from US Scientists to the EC 08 2013)

"Forest

Bionergy for Europe - What science can tell us" EFI (2014)

"Review

of literature on biogenic carbon and life cycle assessment of forest

bioenergy" Forest research (05 2014)

"State

of play on the sustainability of solid and gaseous biomass used for

electricity, heating and cooling in the EU" EC (2014)

"Carbon

Emissions and Climate Change Disclosure by the Wood Pellet Industry –

A Report to the SEC on Enviva Partners LP" Partnership for Policy

Integrity and Dogwood Alliance (03 2016)

"Woody

Biomass for Power and Heat: Impacts on the Global Climate" D Brack

for Chatham House (02 2017)

|